MONDAY: 21 August 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

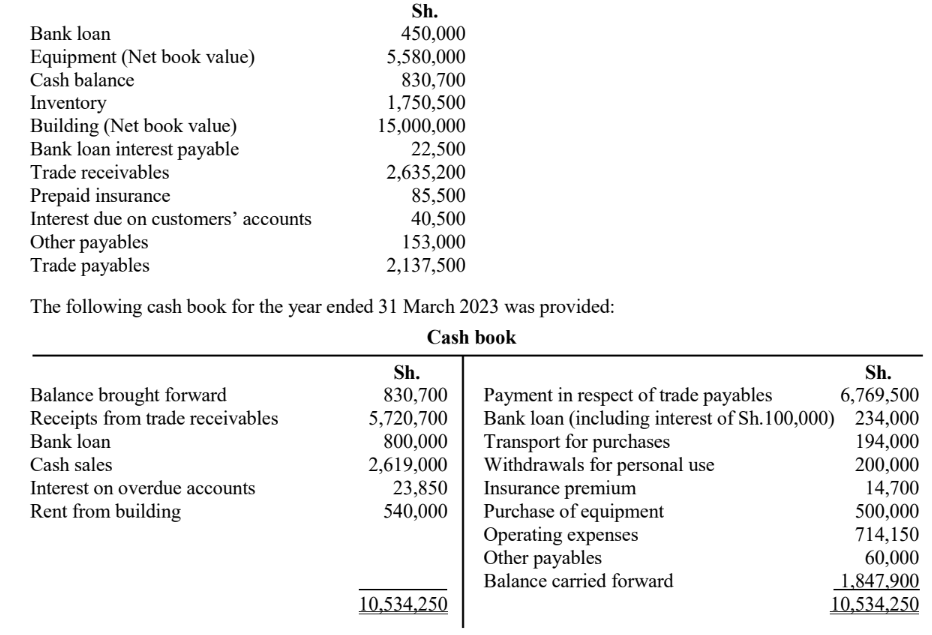

1. Feisal Rajab runs a business as a sole trader under the name Feraj Traders. The following balances of assets and liabilities were extracted from Feraj Traders’ books of account as at 31 March 2022:

Additional information:

1. Inventory as at 31 March 2023 was valued at Sh.3,500,000.

2. Returns inwards and returns outwards from credit transactions were Sh.100,000 and Sh.80,000

respectively.

3. Discounts allowed amounted to Sh.75,000 while discounts received were Sh.112,000.

4. Depreciation was to be provided as follows:

Asset Rate per annum

• Building 5% on the reducing balance

• Equipment 25% on the reducing balance

5. Trade payables balance as at 31 March 2023 amounted to Sh.850,000 while trade receivables at the

same date amounted to Sh.1,100,000 excluding interest on overdue accounts. All purchases were on

credit.

6. Trade receivables of Sh.42,000 had been written off during the accounting period. Sh.43,400 of the

trade receivables as at 31 March 2023 may be uncollectible and an allowance for this is required.

7. Prepaid insurance as at 31 March 2023 amounted to Sh.25,000.

Required:

Statement of profit or loss for the year ended 31 March 2023. (10 marks)

Statement of financial position as at 31 March 2023. (10 marks)

(Total: 20 marks)

QUESTION TWO

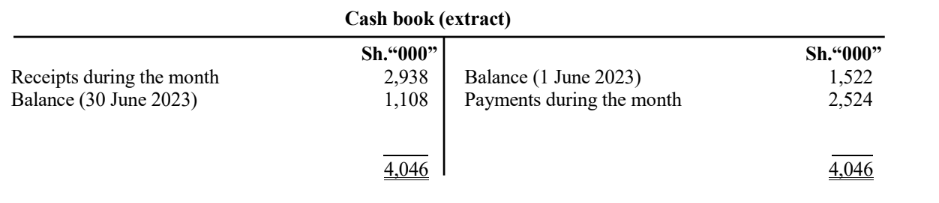

1. The bank statement of Maji Marefu Enterprises as at 30 June 2023 showed an overdraft of Sh.2,324,000 while the bank balance as per the cash book showed a credit balance of Sh.1,108,000.

The following extract from the cash book of Maji Marefu Enterprises for the month of June 2023 was provided:

Upon investigation, the following matters were discovered:

1. A cheque received for Sh.160,000 had been returned unpaid. No adjustment had been made in the

cash book.

2. During the month of June 2023, dividends amounting to Sh.124,000 were credited directly into the

bank account, but no entries had been made in the cash book.

3. A cheque drawn for Sh.12,000 had been incorrectly entered in the cash book as Sh.132,000.

4. The balance brought forward as per the above cash book was overstated by Sh.100,000.

5. Bank charges amounting to Sh.272,000 appeared in the bank statement only.

6. Cheques drawn amounting to Sh.554,000 had not been presented to the bank for payment.

7. Cheques received totalling Sh.1,524,000 had been entered in the cash book and deposited in the bank,

but were not credited until 5 July 2023.

8. A cheque for Sh.54,000 had been entered as a receipt in the cash book instead of a payment.

9. A cheque for Sh.50,000 had erroneously been debited by the bank into Maji Marefu’s account.

Required:

The adjusted cash book balance as at 30 June 2023. (6 marks)

Bank reconciliation statement as at 30 June 2023. (4 marks)

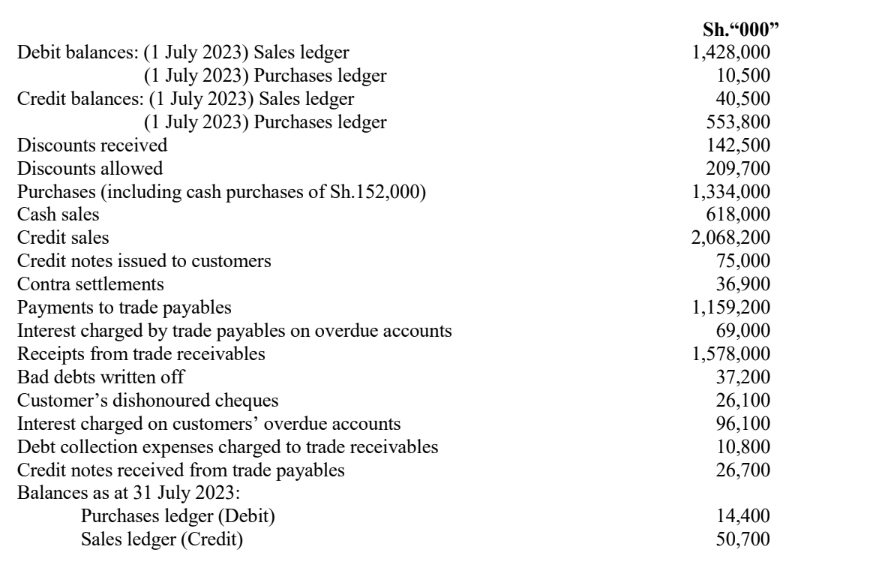

2. The following balances were extracted from the books of Juhudi Traders for the month of July 2023:

Required:

Sales ledger control account for the month ended 31 July 2023. (5 marks)

Purchases ledger control account for the month ended 31 July 2023. (5 marks)

(Total: 20 marks)

QUESTION THREE

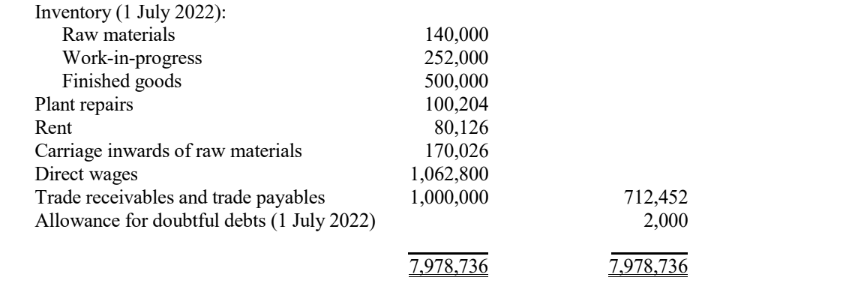

Faida Ltd. is a company that manufactures and supplies gas cylinders. The following trial balance was extracted from the books of the company as at 30 June 2023:

Additional information:

1. Allowance for doubtful debts is to be maintained at 2% of the trade receivables balance as at 30 June 2023.

2. Inventory as at 30 June 2023 was valued as follows:

Raw materials Sh.116,000,000

Work-in-progress Sh. 64,000,000

3. Light and heat of Sh.1,500,000 and rent of Sh.2,400,000 were accruing as at 30 June 2023, while rates of Sh.4,200,000 and insurance of Sh.3,200,000 relates to the period ending 30 June 2024.

4. Rent, rates, light and heat as well as insurance are to be apportioned in the ratio 80% to factory and 20% to administration.

5. Depreciation is to be provided at the following rates:

6. The company completed 2,000 units during the year and only 150 units were in the inventory as at

30 June 2023.

7. Corporation tax is to be provided at the rate of 30%.

Required:

Manufacturing statement for the year ended 30 June 2023. (10 marks)

Statement of profit or loss for the year ended 30 June 2023. (10 marks)

(Total: 20 marks)

QUESTION FOUR

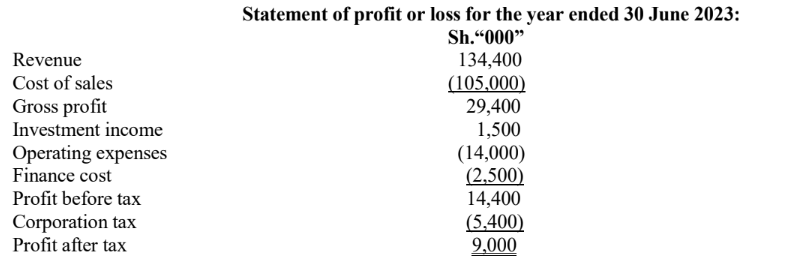

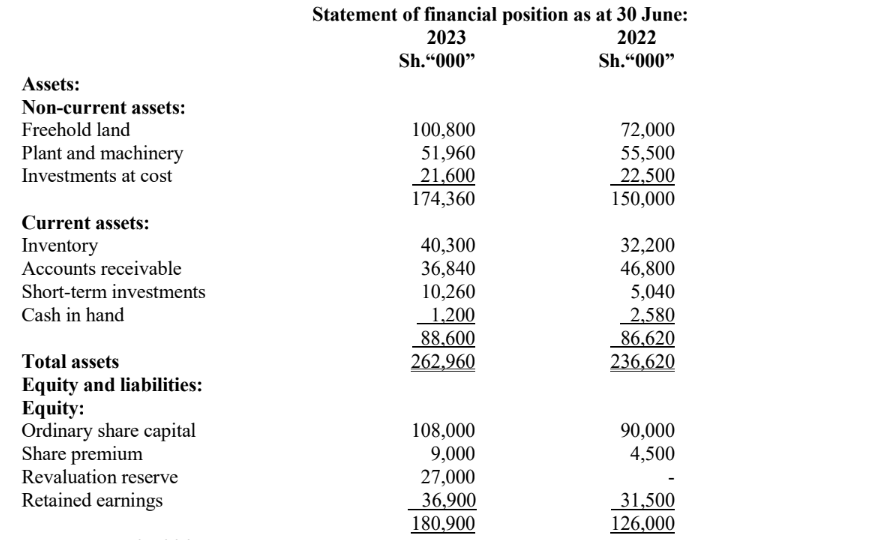

The following information was extracted from the financial statements of Biashara Ltd. for the year ended 30 June 2023:

Additional information:

1. The revaluation reserve relates to freehold land.

2. Depreciation on plant and machinery amounting to Sh.6,900,000 was charged to the statement of profit or loss for the year.

3. Part of the long-term investments were sold during the year at a profit of Sh.960,000.

4. During the year, plant with a net book value of Sh.4,500,000 was sold for Sh.8,820,000. The plant had an original cost of Sh.18,000,000. 5. The following is an extract from the statement of changes in equity for the year ended 30 June 2023 (Retained earnings column only):

Required:

Statement of cash flows for the year ended 30 June 2023 in accordance with International Accounting

Standards (IAS) 7 “Statement of Cash Flows”. (14 marks)

Comment on how Biashara Ltd. has generated and used its cash and cash equivalents for the year ended

30 June 2023. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the nature of the accounting equation. (4 marks)

2. Highlight FOUR advantages of books of prime entry. (4 marks)

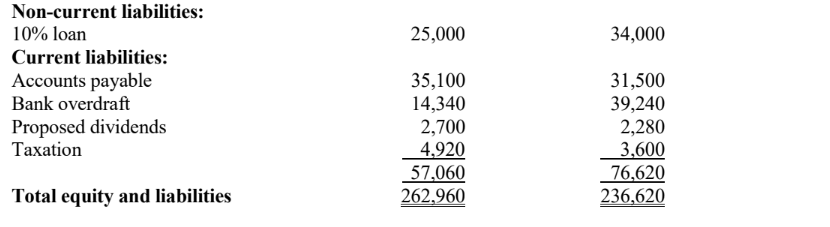

3. The following statement of financial position as at 30 June 2023 was prepared by an inexperienced

bookkeeper:

Additional information:

1. A new machine purchased for Sh.2,300,000 had been recorded in the repairs account.

2. An inventory sheet had been misplaced causing the closing inventory to be undercast by Sh.2,300,000.

3. An invoice from a supplier of Sh.1,460,500 had been omitted from the books.

4. Bank reconciliation had not been done and the following items on the bank statement had not been

entered in the books:

• Bank charges Sh. 1,150,000

• Standing order for rent payment Sh. 805,000

5. An additional allowance of Sh.575,000 is required in respect of doubtful debts.

6. No provision has been made for electricity expense of Sh.402,500 and audit fees of Sh.1,035,000.

7. The company has signed an agreement to buy a new plant costing Sh.8,050,000 to be delivered and

installed in six months’ time.

8. Depreciation on non-current assets is provided at 10% per annum on straight line basis. A full

year’s depreciation is charged in the year of purchase.

Required:

Journal entries to correct the above errors. (Narrations not required). (6 marks)

Corrected statement of profit or loss for the year ended 30 June 2023. (6 marks)

(Total: 20 marks)