THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer any FIVE questions. ALL questions carry equal marks.

QUESTION ONE

1. In exercising judicial authority, the courts and tribunals shall be guided by certain principles.

With reference to the above statement, summarise five of these principles. (5 marks)

2. Describe five types of jurisdiction of the High Court in your country. (5 marks)

3. Based on your assessment of Central Depository Laws and Regulations, discuss five protective measures that exist to ensure protection of depositor’s investment. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. In the context of regulation of financial services:

Explain the meaning of the term “regulatory strategy”. (2 marks)

Describe four steps to be adhered to in developing a successful regulatory strategy. (4 marks)

2. Musa Siri, a finance manager at Spider Web Company Limited is in the process of opening a central depository account for the company. Spider Web Limited is 99% owned by foreign companies incorporated in the Cayman Islands, a tax haven. Most of the company’s finances are transported in cash to financial institutions abroad and the only physical assets the company owns locally are securities held in various listed companies.

The Chief Risk and Compliance Officer has informed you that Spider Web Limited is a high risk company.

Required:

Define the term “high risk”. (2 marks)

Describe six additional steps you would undertake in the due diligence of a high-risk client. (6 marks)

Enumerate six steps you would undertake in conducting the due diligence exercise that ought to proceed the opening of a central depository account. (6 marks)

QUESTION THREE

1. James Shoka is aggrieved by the decision of the Capital Markets Authority’s refusal to grant a license to conduct the business of an Investment Adviser. James Shoka has been advised that such decisions could be appealed against to the Capital Markets Tribunal.

With reference to the above case scenario, describe five other decisions of the Capital Markets Authority that could be appealed against to the Capital Markets Tribunal. (10 marks)

2. The Board of directors of Hope Limited, a company that trades in the financial markets has requested their company secretary, Eunice Mueni to prepare a corporate governance framework to protect their shareholders’ rights in the financial markets.

Required:

Prepare a template showing ten shareholder rights that Eunice Mueni might include in Hope Limited’s corporate governance framework. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Jack Daniel is an inexperienced investor at the Securities Exchange and has been advised by his stock broker to seek the services of an Investment Adviser. Jack Daniel approaches you for advice regarding the duties of an Investment Adviser.

In relation to the above facts, advise Jack Daniel on three duties of an Investment Adviser. (6 marks)

2. With specific reference to foreign investments:

Identify three types of foreign assets. (3 marks)

A foreign national who proposes to invest foreign assets may apply for a certificate that the enterprise in which the assets are proposed to be invested is approved.

Summarise five particulars that the above certificate shall contain. (5 marks)

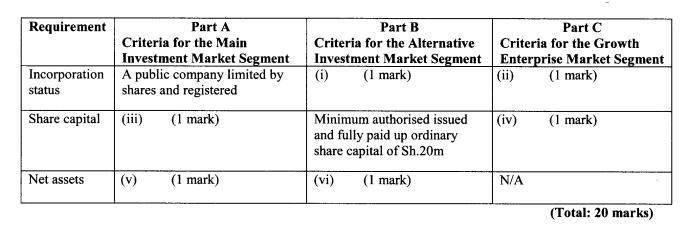

3. Complete the table below with reference to eligibility requirements for public offering of shares and listing:

QUESTION FIVE

1. You are the promoter of a collective investment scheme and you are prepring the documents required for an application for registration of a collective investment scheme.

Summarise eight documents that should accompany the application. (8 marks)

2. Identify two pieces of information that are ideally contained in a warning statement included in advertisements by a collective investment scheme. (2 marks)

3. Assuming X makes an offer to Y and before acceptance X changes his mind.

Advise X on five ways through which X could terminate the offer. (10 marks)

(Total: 20 marks)

QUESTION SIX

1. Describe the following types of agents:

Mercantile agent. (2 marks)

Factors. (2 marks)

Commission agent. (2 marks)

Del credere agent. (2 marks)

Broker. (2 marks)

2. Explain five roles of the Institute of Certified Investment and Financial Analysts (ICIFA). (5 marks)

3. Highlight five circumstances under which a person could be disqualified from being registered as an investment and financial analyst. (5 marks)

(Total: 20 marks)

QUESTION SEVEN

1. Outline five types of financial market intermediaries. (5 marks)

2. A central depository may establish a Central Depository Guarantee Fund.

With reference to the above statement, enumerate the constituent of the fund. (5 marks)

3. With specific reference to prevention of money laundering in your country:

Analyse seven functions of the Assets Recovery Agency (ARA). (7 marks)

Summarise three core elements of the Customer Due Diligence (CDD) rule that might be included in an Anti Money Laundering (AML) programme. (3 marks)

(Total: 20 marks)