MONDAY: 24 April 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain the use of the following source documents in the business transactions:

-

- Goods received note (GRN). (2 marks)

- Remittance advice (2 marks)

- Debit (2 marks)

2. On preparation of the final books of account of Nari Enterprises, the accountant noted the following errors:

- Additional capital of 1,000,000 paid into the bank had been credited to sales.

- Goods worth 700,000 taken by the owner for own use had been debited to general expenses.

- Private insurance amounting to 98,000 had been debited to the insurance account.

- Cash from the business deposited into the bank account amounting to 390,000 had been credited to the bank column and debited to the cash column of the cash book.

- Cash drawings of 40,000 had been credited to the bank column of the cash book.

- Returns inward of 116,800 from Tandy had been entered erroneously in Trendy’s account.

- The sale of a motor van of 3,000,000 had been credited to motor van expenses account.

Required:

Prepare journal entries to correct the errors. (Narrations are required). (14 marks)

(Total: 20 marks)

QUESTION TWO

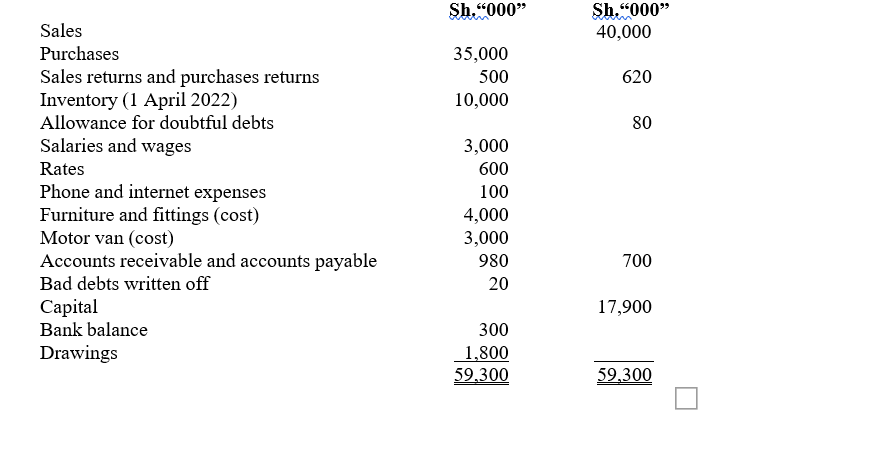

Wendy Dani is a sole proprietor. The following trial balance was extracted from her books as at 31 March 2023:

Additional information:

- As at 31 March 2023, inventory was valued at 13,500,000 (net realisable value) and Sh.12,000,000 (cost).

- As at 31 March 2023, accrued wages were valued at 500,000 and rates pre-paid amounted to Sh.50,000.

- The allowance for doubtful debts is to be increased to 10% of accounts receivable as at 31 March

- Phone and internet charges outstanding as at 31 March 2023, amounted to 22,000.

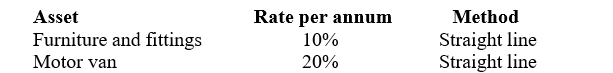

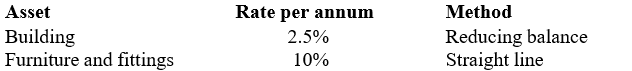

- Depreciation is to be provided per annum as follows:

Required:

- Statement of profit or loss for the year ended 31 March (12 marks)

- Statement of financial position as at 31 March (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight FOUR uses of a trial (4 marks)

2. Explain the following accounting concepts:

-

- Substance over (2 marks)

- (2 marks)

- (2 marks)

- (2 marks)

3. Amuah Traders have provided you with the following cash transactions for the month of March 2023: March: 1 Balances as at bank 3,840,000 and Sh.2,400,000 cash in hand.

1 Paid rent amounting to 240,000 in cash.

2 Made annual payment for internet amounting to 38,400 in cash.

4 Paid electricity expenses of Sh.24,000 in cash.

8 Sold goods and was paid in cash an amount of Sh.592,000.

10 Received payment of 89,200 through cheque from Wayne Limited.

11 Deposited 1,088,000 into the bank account from the business.

13 Made payment through cheque amounting to Sh.2,202,500 to Caol Waters Ltd.

20 Paid for advertisement amounting to Sh.115,200 in cash.

29 Sent a cheque to Konny of Sh.720,000.

31 Drew a cheque for own use amounting to Sh.480,000.

31 Deposited Sh.1,240,800 cash into the bank from the business.

Required:

Two column cash book duly balanced as at 31 March 2023. (8 marks)

(Total: 20 marks)

QUESTION FOUR

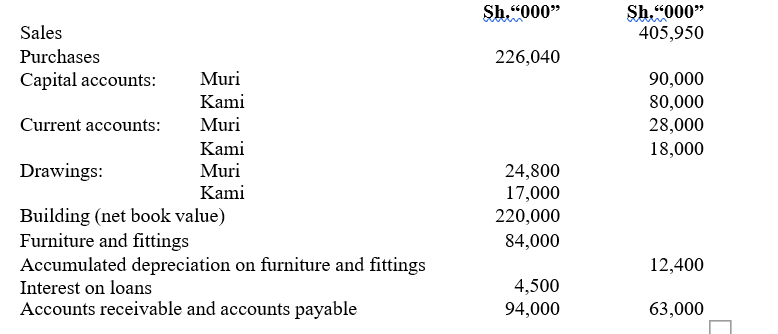

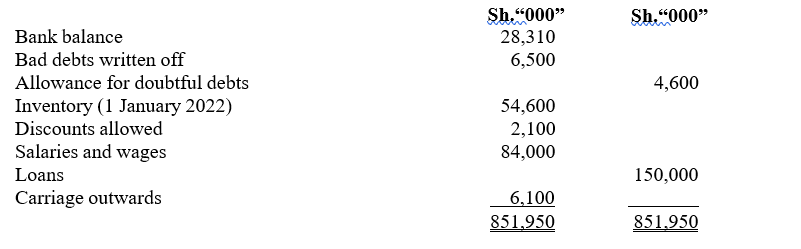

Muri and Kami are in a partnership trading under the name Murika Partnership. Muri and Kami share profits and losses in the ratio 2:3 respectively. The following trial balance was extracted from their books as at 31 December 2022:

Additional information:

- As at 31 December 2022, inventory was valued at 12,000,000.

- Depreciation is provided as follows

- As at 31 December 2022, accrued salaries amounted to 400,000.

- The partnership agreement provides for interest on drawings at 5% per annum and interest on capital at 10% per

- Only Kami is entitled to an annual salary of 12,000,000.

- Allowance for doubtful debts is to be reduced by 1,200,000.

- Interest on loans is charged at a rate of 5% per

Required:

- Statement of profit or loss and appropriation account for the year ended 31 December (8 marks)

- Partners’ current accounts as at 31 December (4 marks)

- Statement of financial position as at 31 December 2022. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. There are various types of errors in financial Some errors affect the trial balance and some errors do not affect the trial balance.

In light of the above, highlight:

- FIVE errors affecting the trial (5 marks)

- FOUR errors not affecting the trial (4 marks)

2. On 3 April 2023, Mutua Mule, a sole trader received this bank statement for the month of March As at that date, his bank balance was Sh.7,937,500 while his cash book balance was Sh.11,832,500.

His accountant investigated the matter and discovered the following discrepancies:

- Bank charges of 15,000 had not been entered in the cash book.

- Cheques drawn by Mutua Mule amounting to 112,500 had not been presented to the bank.

- Receipts amounting to 132,500 had not been entered in the cash book.

- A cheque amounting to 492,500 deposited into the bank on 31 March 2023 had not yet been credited by the bank.

- Standing order payments amounting to 310,000 had not been entered in the cash book.

- A payment amounting to 749,000 had been entered as Sh.794,000 in cash book.

- A cheque amounting to 75,000 received on 12 March 2023 was dishonoured by the bank and returned. No record had been made in the cash book.

- Mutua Mule’s opening cash balance of 1,646,250 had been brought forward as a debit balance instead of a credit balance.

Required:

- Adjusted cash (7 marks)

- Bank reconciliation statement as at 31 March (4 marks)