MONDAY: 21 August 2023. Afternoon Paper. Time Allowed: 3 hours

Answer ALL questions. Marks Allocated to each question are shown at the end of the question. Show ALL your workings. Do not write anything on this paper.

QUESTION ONE

1. List FOUR examples of costs that are relevant for decision making process. (4 marks)

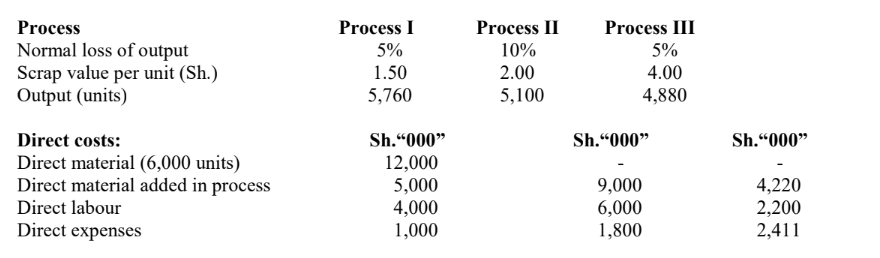

2. A product is manufactured by passing it through three processes namely: Process I, II and III respectively. For the first week of July 2023, the actual data included the following:

Additional information:

1. Budgeted production overhead for the week is Sh.30,500,000 and are absorbed based on direct labour cost.

2. Budgeted direct wages for the week amounted to Sh.12,200,000.

Required:

Process I account. (5 marks)

Process II account. (5 marks)

Process III account. (6 marks)

(Total: 20 marks)

QUESTION TWO

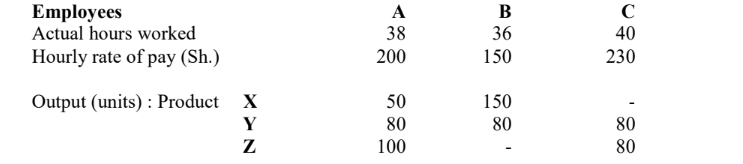

1. Rindo Ltd. is considering the type of remuneration scheme to adopt for its employees. The following information is availed to you for your analysis:

Additional information:

1. The standard time allowed per unit is 10 minutes for product X, 20 minutes for product Y and 30 minutes for product Z respectively.

2. For the calculation of piece-rates system, the company values each minute at the rate of Sh.8.

Required:

Calculate the earnings for each employee using:

Basic guaranteed time rates. (3 marks)

Piecework rates. (6 marks)

2. The following information has been extracted from the books of Delta Ltd. for the year to 31 July 2023:

Required:

Prepare statement of profit or loss using the following costing techniques:

Marginal costing. (5 marks)

Absorption costing. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe FOUR distinguishing features between “financial accounting” and “management accounting”. (4 marks)

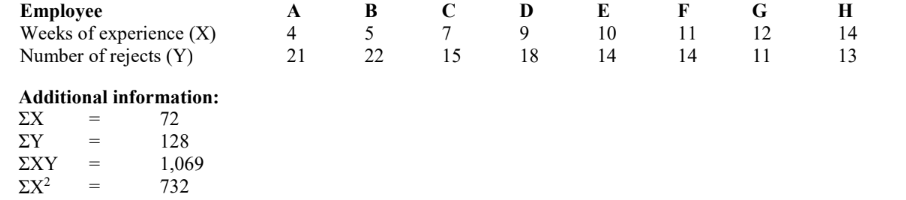

2. Mwangaza Factory Ltd. manufactures fluorescent bulbs. The factory has taken a sample of eight employees from its production department for quality assurance.

The following data relate to the number of weeks of experience in the wiring of components and the number of components which were rejected as unsatisfactory last year:

Required:

The least squares regression equation of rejects on experience in the form of Y = a + bx. (4 marks)

Predict the number of rejects you would expect from employee K with one week of experience. (2 marks)

If each rejected unit costs the factory Sh.55, compute the total rejection cost of employee K with one week of experience. (2 marks)

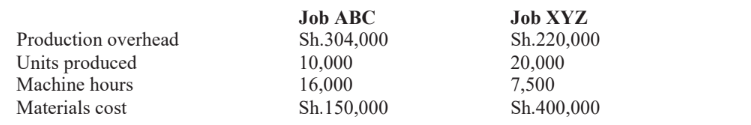

3. Fashion Dressmakers Ltd. makes ladies dresses using job costing method. Two jobs namely “ABC” and “XYZ” use predetermined overhead rates to apply manufacturing overhead to production departments. Job ABC is based on machine hours while job XYZ is based on percentage of materials cost.

Budgeted production and cost data for the two jobs are as follows:

Additional information:

1. At the end of the year 2022, Job ABC had incurred production overhead cost amounting to Sh.305,000 and had produced 9,800 units using 15,990 machine hours and materials costing Sh.147,000.

2. Job XYZ had incurred production overhead cost amounting to Sh.216,000 and had produced 20,500 units using 7,550 machine hours and materials costing Sh.395,000.

Required:

Compute the predetermined overhead absorption rates (OAR) for Job ABC and Job XYZ. (4 marks)

Determine the extent of over/under absorption of overhead for each job. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Evaluate FOUR advantages of centralised material purchasing by an organisation. (8 marks)

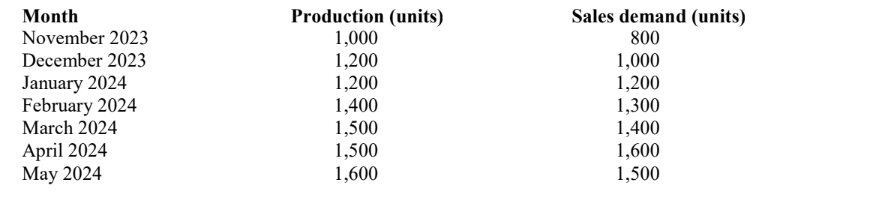

2. Shauri Moyo Bakery Ltd. planned production and sales for the next seven months for the financial year 2023/2024 is as follows:

Additional information:

1. The selling price per unit will be Sh.30,000 throughout the period. 40% of the sales are normally made on one month’s credit. The other 60% are settled in cash within the month of sale.

2. Purchases of raw materials are Sh.10,000 per unit of production and will be paid after one month delay.

3. Direct wages is Sh.6,000 per unit of production. Time lag in payment of wages is 50% in the month of sale and the balance in the month following month of sale.

4. During the period, the business plans to advertise its products. Payment for advertisement of Sh.10,000,000 and Sh.15,000,000 will be made in January and March 2024 respectively.

5. Production overheads during the period to 31 December 2023 had been at Sh.18,000,000 a month and are expected to rise by Sh.2,000,000 per month.

6. A new baking oven machine will be bought and delivered in December 2023. The machine will cost

Sh.66,000,000. This will be paid in three equal installments in January, February and March 2024.

7. A loan of Sh.100,000,000 is being issued in December 2023 and the amount is expected to be received in early February 2024. Interest on loan at a rate of 1% per month shall be charged from February 2024.

8. An outstanding tax liability of Sh.16,000,000 is due in March 2024. In the same month the company intends to dispose of surplus baking ovens with a net book value of Sh.11,000,000 for Sh.6,000,000.

9. A depreciation expense is expected to be 5% of actual sales per month.

10. The bank balance as at 1 January 2024 is expected to be Sh.15,000,000 deficit.

Required:

A cash budget for the four months ending 30 April 2024. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the relevance of the following terms as used in management accounting:

Break-even analysis. (2 marks)

Responsibility centre. (2 marks)

Batch costing. (2 marks)

2. Analyse FOUR limitations that a firm would encounter when operating a marginal costing system. (8 marks)

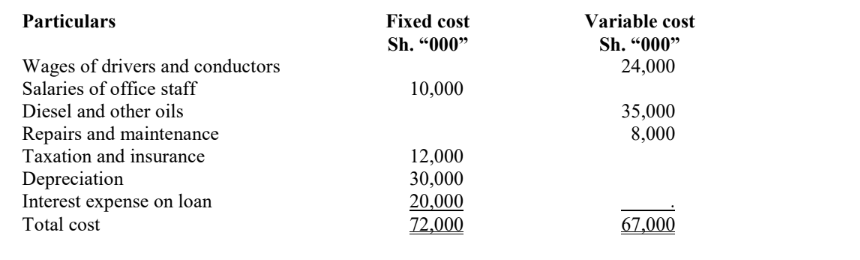

3. Tausi Tours Ltd. is a transport service company that runs five buses between two towns which are 50 kilometres apart. Seating capacity of each bus is 50 passengers. The following particulars were obtained from the books of the company for the month of March 2023:

Additional information:

1. Actual passengers were 75% of seating capacity.

2. All buses operated on all 30 days of the month.

3. Each bus made one round trip per day.

Required:

Calculate the cost per passenger per kilometre per day. (6 marks)

(Total: 20 marks)