MONDAY: 24 April 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Distinguish between “process costing” and “batch costing”. (4 marks)

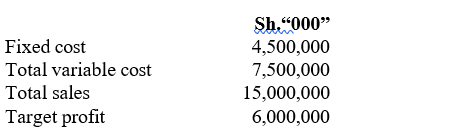

2. Tegemeo Battery manufactures long lasting batteries for both domestic and commercial vehicles. The following information is provided for the year ended 31 December 2022:

Required:

- The contribution to sales (C/S) ratio (2 marks)

- The break-even point (BEP) in sales value (2 marks)

- Amount of sales required to achieve the target profit (2 marks)

- Sales value to cover extra 1.5 million advertising expenditure. (2 marks)

3. Bongo ’s budgeted overheads for the forthcoming period applicable to its production departments; A and B are as follows:

Production department Sh.“000”

A 240,000

B 180,000

The budgeted total costs for the same period for the service departments C and D are as follows:

Service department Sh.“000”

C 86,000

D 44,000

Additional information:

- The proportionate use of the services has been estimated as follows:

Required:

- Reapportion the service departments cost to production departments using simultaneous equation method (6 marks)

- The overhead absorption rate (OAR) of each production department (2 marks)

(Total: 20 marks)

QUESTION TWO

1. In the context of budgetary control:

- Outline FOUR objectives of budgeting (4 marks)

- Highlight FOUR criticisms of budgeting (4 marks)

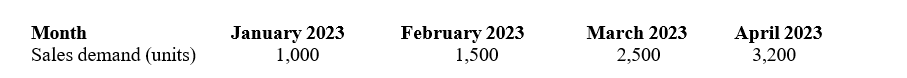

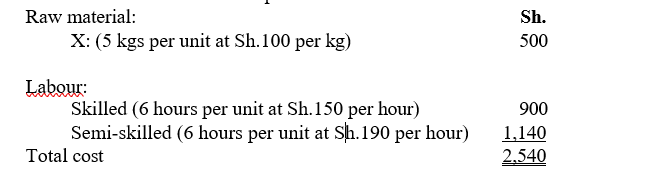

2. Pamoja Enterprises Ltd. makes and sells a single product branded “PMJ” using a single type of raw materials and two types of labour.

The firm is now preparing its budget for the first quarter of the year 2023. The following information has been identified for product “PMJ”.

Additional information:

- Selling price per unit will be 2,500 in January 2023. It will increase by 10% per month.

- The various cost elements for production are as follows:

3. Closing inventory of finished goods is 30% of the monthly sales The closing inventory for December 2022 was 450 units.

4. Closing inventory of raw material is 20% of the next month’s The closing inventory for December 2022 was 850 units.

Required:

- Production budget in units (4 marks)

- Material purchase budget in shillings (4 marks)

- Direct labour budget for skilled labour (4 marks)

(Total: 20 marks)

QUESTION THREE

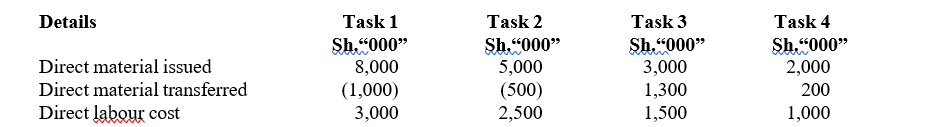

1. The following information relates to several tasks at Ayub for the month of March 2023:

-

- The company received four tasks and incurred the following costs on them:

2. Factory production overheads are absorbed at the rate of 50% of prime

3. On completion of a task, the company charges administration, selling and distribution cost at the rate of 30% of total factory cost.

4. During the month, Tasks 1, 2 and 3 were completed

5. The company’s policy is to earn a profit margin of 20% on every task

Required:

- Compute the total factory cost for each task done in the month of March 2023 (8 marks)

- Determine the invoice price for each of the completed task (3 marks)

2. Malimali Ltd. is considering the possibility of outsourcing component “Zed” which it currently makes from Topdown Suppliers. Topdown Suppliers will supply the component which has the following requirements of an economic order quantity model:

- Annual requirement 20,000 units

- Ordering cost 1,000 per order

- Purchase price per unit 40

- Carrying cost per annum per unit 16% of the purchase price

Additional information:

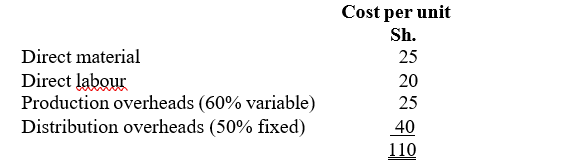

- If Malimali Ltd. continues to make 20,000 units per annum of component Zed, its cost budget will be as follows:

2. The fixed overheads above are absorbed based on a budgeted production and sales capacity of 25,000 units

3. If Malimali continues to make product “Zed”, then the cost of direct material will rise by 2% but direct labour cost will fall by 2%.

4. Fixed distribution overheads are unavoidable costs if Malimali Ltd. outsource the component but fixed production overheads will go down by 30%

Required:

Advise Malimali Ltd. whether to make or buy component “Zed” from Topdown suppliers. (9 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight FOUR advantages of time rate system over piece rate system of labour remuneration (4 marks)

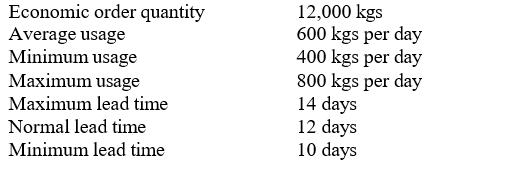

2. Vendit obtains component “K” from a specialist supplier. The daily usage for the component and the time between placing and receiving an order can vary as follows:

Required:

- Reorder level (2 marks)

- The maximum inventory level (2 marks)

- The minimum inventory level (2 marks)

3. A company currently remunerates its factory workers on time basis and is now considering the introduction of alternative methods of remuneration.

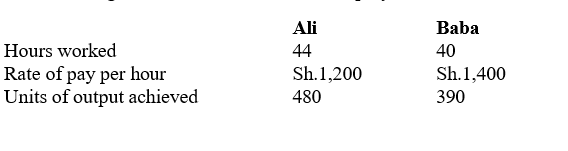

The following information relates to two employees for one week:

Additional information:

- The time allowed for each unit of output is seven standard minutes

- For purposes of piecework calculations each minute is valued at 16.

Required:

Compute the earnings of the employees using:

- Piecework rates with earnings guaranteed at 80% of pay calculated on an hourly basis (4 marks)

- Premium bonus scheme in which bonus is based on 75% of time saved and added to pay calculated on an hourly basis (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Summarise FOUR salient features of process costing systems (4 marks)

2. Explain TWO costs that could be classified under the time bases of cost classification (2 marks)

3. Highlight FOUR benefits that a firm would derive from establishing a good cost accounting system (4 marks)

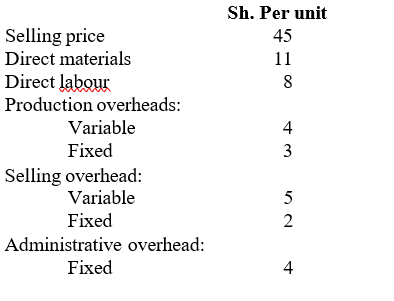

4. Roma is preparing its budgets for the year ending 31 December 2024. It makes and sells a single product, which has budgeted costs and selling price as follows:

Additional information:

- Fixed overhead costs per unit are based on a normal annual activity level of 96,000,000

- These costs are expected to be incurred at a constant rate throughout the year

- Activity levels during the months of January 2024 and February 2024 were expected to be:

Required:

Prepare in columnar format, profit statements for each of the two months of January 2024 and February 2024 using:

- Direct costing method (5 marks)

- Indirect costing method (5 marks)