TUESDAY: 25 April 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Highlight FOUR factors that may determine the amount of cash to be held by a firm (4 marks)

2. Outline FOUR underlying principles of Takaful (Islamic) (4 marks)

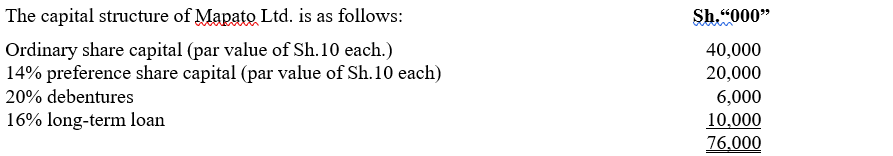

Additional information:

- Ordinary shares are currently trading at 15 on the securities market.

- The company has paid a dividend of 2 per share from an earnings per share (EPS) of Sh.6. The dividends are expected to grow annually at the rate of 40% for the foreseeable future.

- The 20% debentures have a par value of 1,000. The market price of the debentures is currently at Sh.950. The debentures have a maturity of ten years.

- The preference shares are currently trading at 14 per share.

- The company’s tax rate is 30%.

Required:

Determine the following for Mapato Ltd.:

- The cost of ordinary share capital (2 marks)

- The cost of preference share capital (2 marks)

- The cost of debentures (2 marks)

- The cost of long-term loan (after tax). (2 marks)

- The company’s market weighted average cost of capital (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain THREE causes of conflict between the government and shareholders (6 marks)

2. Differentiate between “compounding techniques” and “discounting techniques” as used in time value of money (4 marks)

3. Josphat Mwanzia has invested in a portfolio that comprises two stocks; A and B as shown below:

Required:

Compute the following for Josphat Mwanzia:

- Expected return of the portfolio (3 marks)

- Covariance of the portfolio (3 marks)

- Standard deviation of the portfolio (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Summarise FOUR advantages of scrip dividend instead of cash dividend (4 marks)

2. Explain the following terms as used in valuation:

- Going concern value (2 marks)

- Liquidation value (2 marks)

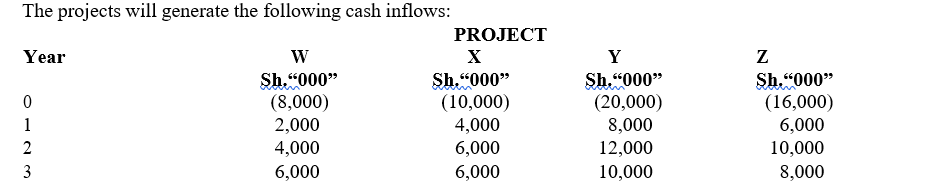

3. Maktaba is considering its capital budget for the year 2024. The following information relates to four mutually exclusive projects that the management is contemplating to undertake:

Additional information:

- The company has a capital budget ceiling of 20 million.

- The cost of capital for Maktaba is 10%.

- The cash flows are assumed to occur at the end of the year.

Required:

Advise the management of Maktaba Ltd. on which project to undertake using the following investment appraisal methods:

- Net present value (NPV). (8 marks)

- Profitability index (PI). (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain THREE reasons why it is not advisable for a company to use a bank overdraft as a short-term source of finance (6 marks)

2. Karibu has annual sales of Sh.12 million and all sales are on 30 days credit period although customers on average take 10 days more than the credit period to pay.

Additional information:

- The company’s gross margin on sales is 40%. The company currently has no bad debts.

- Accounts receivable are financed using a bank overdraft at an annual interest rate of 7%.

- The management has plans to offer an early settlement discount of 5% for payment within 15 days and to extend the maximum credit period offered to 60 days.

- The management expects that these changes will increase annual credit sales by 5% while also leading to additional incremental costs equal to 0.5% of sales revenue.

- The discount is expected to be taken by 30% of the customers with the remaining customers taking an average of 60 days to pay

- Assume 365 days in a year.

Required:

Evaluate whether Karibu Ltd. should adopt the proposed changes in credit policy. (8 marks)

3. Modern Appliance has recently issued a Sh.1,000, 10% convertible bond. The bond can be converted into 20 ordinary shares at the end of five years. The current market price of the shares of Modern Appliance Ltd. is Sh.30 per share. The price is expected to grow at the rate of 10% per annum. The investor’s required rate of return is 14%.

Required:

Determine the current value of the bond. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the term “bird in the hand dividend theory”. (2 marks)

2. Explain TWO reasons why the financing decisions of an organisation are important (4 marks)

3. (i) Outline FOUR challenges encountered by small and medium enterprises (SMEs) in raising capital

(4 marks)

(ii) Simon Kamala obtained a loan from ABC bank of Sh.2 million. The rate of interest was fixed at 12% per annum. The loan is to be repaid semi-annually over a period of 3 years.

Required:

Prepare a loan amortisation schedule over the three year period. (6 marks)

4. Blades Ltd. issued 15% preference shares to raise funds. The shares have a par value of Sh.100 each and currently sell at 140 each. The investor’s minimum required rate of return is 10%.

Required:

- Determine the current intrinsic value of the share (2 marks)

- Advise the investor based on whether to buy or sell the share (2 marks)

(Total: 20 marks)