MONDAY: 4 December 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. The Conceptual Framework for Financial Reporting (the Conceptual Framework), identifies TWO fundamental qualitative characteristics and FOUR enhancing qualitative characteristics that useful financial information is required to have.

Required:

Explain the TWO fundamental qualitative characteristics of useful financial information. (4 marks)

Describe any TWO enhancing qualitative characteristics of useful financial information. (4 marks)

2. Explain TWO functions of each of the following in the management of public finances:

Office of the Auditor General. (2 marks)

Public Accounts Committee. (2 marks)

3. Explain the difference between “reserves” and “provisions”. (4 marks)

4. In the context of the issue of ordinary shares, differentiate between a “rights issue” and a “bonus issue”. (4 marks)

(Total: 20 marks)

QUESTION TWO

Dadu, Elegwa and Fondo have been operating a retail business as partners. The partnership agreement provides that:

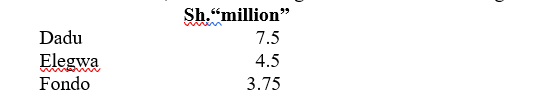

- The partners are to be credited at the end of each year with the following salaries:

2. Each partner is to be credited with interest on capital balances at the beginning of each year at the rate of 5% per annum.

3. No interest is to be charged on drawings.

4. After charging partnership salaries and interest on capital, Dadu, Elegwa and Fondo are to share profits or losses in the ratio of 5:3:2 respectively, with a provision that Fondo’s share in any year (exclusive of salary and interest) shall not be less than Sh.150 million. Any deficiency is to be borne in the profit and loss sharing ratio by the other partners.

The trial balance of the partnership as at 31 December 2022 was as follows:

Additional information:

- Inventory as at 31 December 2022 was valued at Sh.540 million.

- A debt of Sh.9 million is to be written off and the allowance for doubtful debts should be provided at the rate of 5% of the trade receivables on 31 December 2022.

- As at 31 December 2022, salaries and wages included the following monthly drawings by the partners:

- Partners had during the year been supplied with goods from inventory and it was agreed that these should be charged to them as follows:

- On 31 December 2022, rates paid in advance and office expenses owing were Sh.37.5 million and Sh.36 million respectively.

- Professional fees included Sh.37.5 million paid in respect of the acquisition of the buildings.

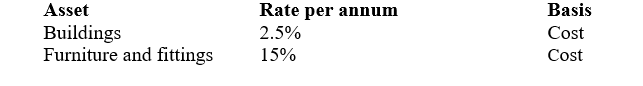

- Depreciation is to be provided as follows:

- The buildings were brought into use during the year ended 31 December 2022.

Required:

Partnership statement of profit or loss and appropriation account for the year ended 31 December 2022.(10 marks)

2. Partners’ current accounts as at 31 December 2022. (4 marks)

3. Statement of financial position as at 31 December 2022. (6 marks)

(Total: 20 marks)

QUESTION THREE

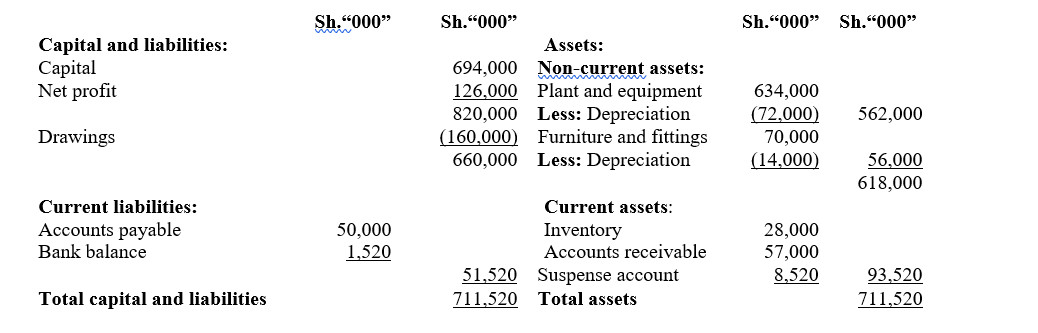

The following is the statement of financial position of Bidii traders as at 30 September 2023.

The statement of financial position was prepared by an inexperienced accounts clerk and included a suspense account balance under current assets.

Investigations revealed the following additional information:

- The purchases day book had been undercast by Sh.2,800,000.

- An item of equipment costing Sh.2,600,000 had been debited to repairs account. Depreciation on equipment is charged at the rate of 15% per annum on cost.

- A debit balance of Sh.2,400,000 for a debtor had been omitted from total accounts receivable.

- An entry of Sh.2,100,000 for return outwards was made in error in the sales day book instead of the purchases returns day book.

- A cheque of Sh.2,250,000 paid to a creditor was correctly posted in the cash book but credited in error to the creditor’s account.

- Goods valued at Sh.220,000 were withdrawn for personal use, but no entry had been made in the books of Bidii Traders.

- A bad debt of Sh.1,250,000 was yet to be written off from the accounts receivable account.

- A discount received of Sh.590,000 had been correctly entered in the cash book, but had been posted to the wrong side of discounts received account.

Required:

Journal entries (including narrations), necessary to correct the above errors. (8 marks)

Suspense account fully balanced. (2 marks)

3. A statement of adjusted profit for the year ended 30 September 2023. (4 marks)

4. A corrected statement of financial position as at 30 September 2023. (6 marks)

(Total: 20 marks)

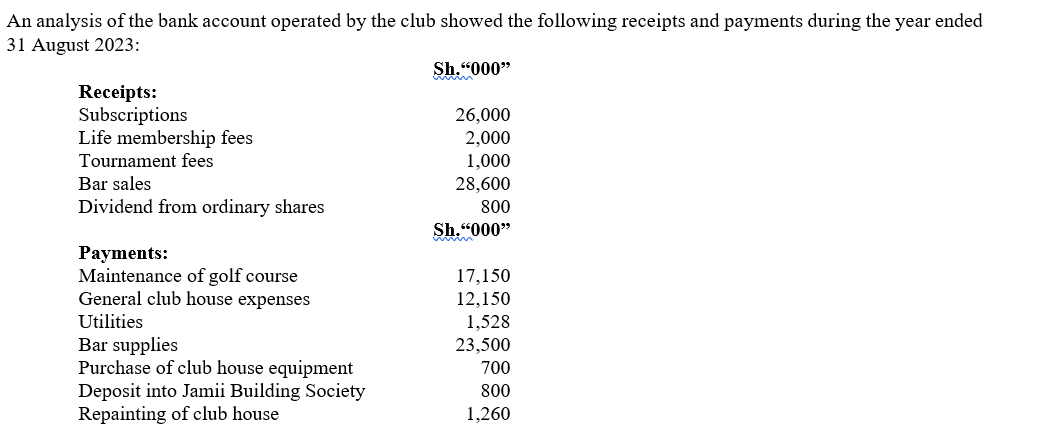

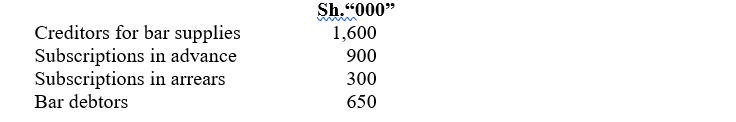

QUESTION FOUR

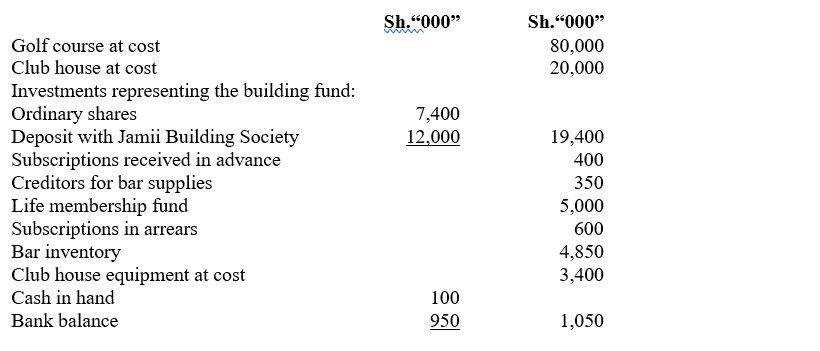

The following balances were extracted from the books of Sagana Golf Club as at 1 September 2022:

Additional information:

- The club maintains a building fund separate from the accumulated fund and life membership fund. The building fund is invested in ordinary shares and also deposited into Jamii Building Society.

- Jamii Building Society has been instructed to credit the interest on the club’s deposits to the club’s account at each half year. Jamii Building Society computes interest half yearly on 28 February and 31 August. For the year ended 31 August 2023, the interest amounted to Sh.840,000. Dividends paid on the ordinary shares are also added to the building fund by paying them into the building society account.

- There were five life members as at 1 September 2022, one of whom died before the end of the year. Two other life members joined the club during the year. Life membership fee is Sh.1,000,000 per member. When a life member dies, his contribution is transferred to the accumulated fund.

- General club house expenses included bar wages of Sh.4,200,000.

- Balances as at 31 August 2023 were as follows:

- As at 31 August 2023, bar inventory was valued at Sh.4,350,000.

- An insurance premium of Sh.480,000 was also included in the general club house expenses that had been paid by cheque. The insurance premium was for the year ended 30 November 2023.

Required:

Bar statement of profit or loss for the year ended 31 August 2023. (4 marks)

Statement of income and expenditure for the year ended 31 August 2023. (8 marks)

Statement of financial position as at 31 August 2023. (8 marks)

(Total: 20 marks)

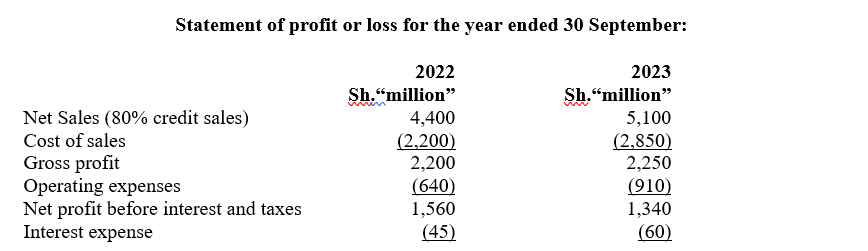

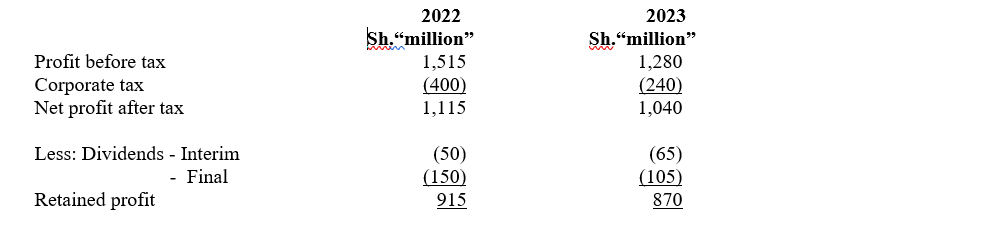

QUESTION FIVE

1. Highlight SIX reasons why it is necessary to make adjustments to accounts at the end of the accounting year. (6 marks)

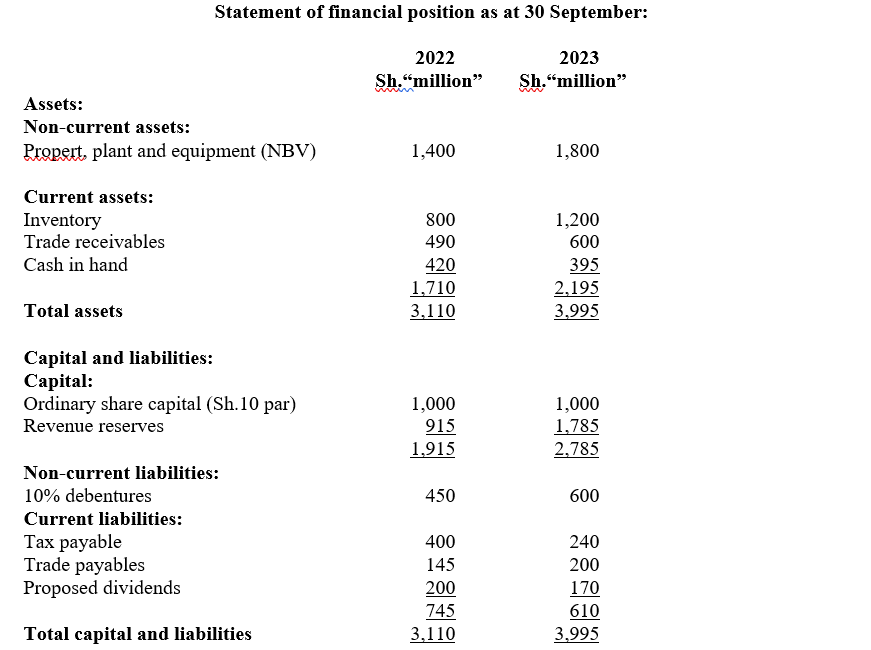

2. The following are the financial statements of Utajiri Ltd. for the two years ended 30 September 2022 and 30 September 2023:

Required:

Compute the following ratios for the years ended 30 September 2022 and 30 September 2023. Assume a 365-day year.

Current ratio. (2 marks)

Quick ratio. (2 marks)

Average trade receivables collection period. (2 marks)

Gross profit margin. (2 marks)

Interest cover. (2 marks)

Return on capital employed (ROCE). (2 marks)

Earnings per share (EPS). (2 marks)

(Total: 20 marks)