MONDAY: 24 April 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Enumerate FOUR reasons for the valuation of securities or firms. (4 marks)

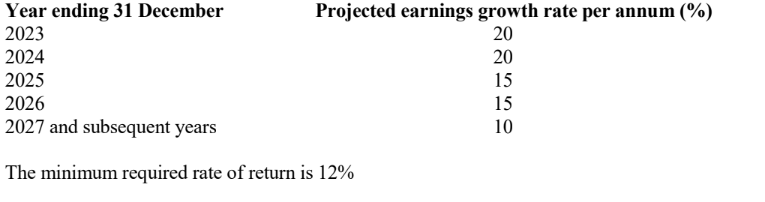

2. Zatex Ltd. paid an ordinary dividend of Sh.3.60 per share for the year ended 31 September 2022. The management of the company projects that the earnings of the company will increase in the coming years as follows:

Required:

Calculate the intrinsic value of the share using Gordon’s growth model. (6 marks)

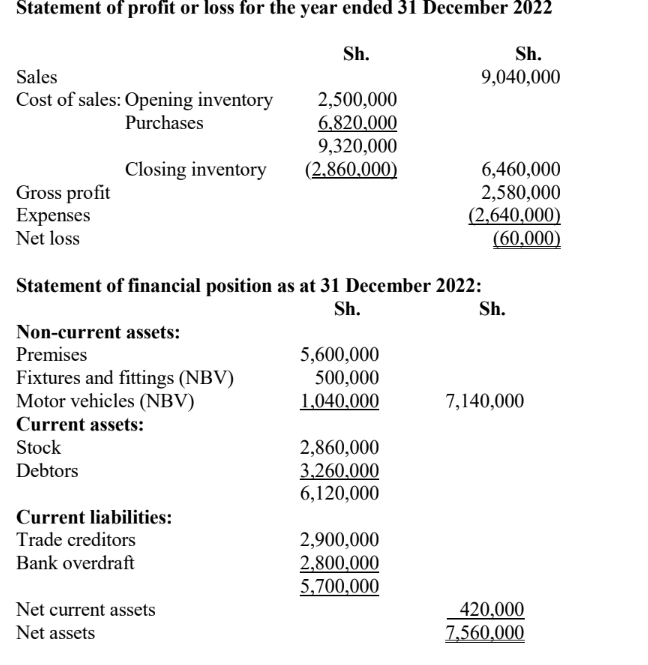

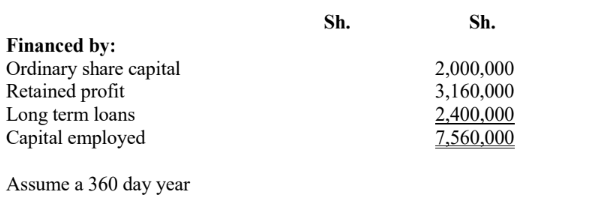

3. Wauzaji Ltd. presented the following financial statements for the year ended 31 December 2022:

Required:

Compute.

Current ratio. (2 marks)

Quick ratio. (2 marks)

Gross profit margin ratio. (2 marks)

Debtors collection period. (2 marks)

Creditors payment period. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain FOUR reasons why the cost of capital is important to a firm. (4 marks)

2. Discuss THREE benefits of working capital management. (6 marks)

3. The following information relates to product X which is manufactured and sold by Neema Ltd.:

Required:

Calculate the level of profits in the following independent situations:

The level of output is 1,000 units. (2 marks)

The level of output is 750 units. (2 marks)

The selling price per unit falls to Sh.1,900 and the level of output produced increases to 1,500 units. (3 marks)

Direct material unit cost falls to Sh.500, selling price falls to Sh.1,900 per unit and the output produced

rises to 1,750 units. (3 marks)

(Total: 20 marks)

QUESTION THREE

1.Describe the following categories of agency conflicts:

Managers versus shareholders. (2 marks)

Creditors versus shareholders. (2 marks)

Shareholders versus employees. (2 marks)

2. Discuss FOUR reasons why accounting profits might not be the best measure of a company’s performance. (8 marks)

3. Kelly Neno borrowed Sh.1,000,000 from a local bank at an interest rate of 15% per annum to be repaid in equal annual repayments for the next six years.

Required:

Prepare a loan amortisation schedule. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight SIX factors that might influence a company’s capital structure. (6 marks)

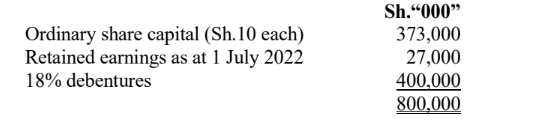

2. Jawabu Ltd.’s capital structure as at 1 October 2022 was as follows:

The company is considering the acquisition of an investment project that will cost Sh.270 million. In order to finance the investments project, the company would be required to raise additional capital.

Additional information:

1. The above capital structure is considered optimal.

2. The company can obtain additional debentures at an interest rate of 18% per annum.

3. The dividend for the year ended 30 September 2022 was expected to be Sh.2.40 per share.

4. Additional ordinary shares can be issued in the securities exchange at a price of Sh.54 per share net of

floatation cost of Sh.6 per share.

5. Dividends are expected to grow at a rate of 8% per annum for the foreseeable future.

6. Corporation tax is 30%.

7. The company will utilise 100% of its retained earnings.

Required:

Calculate:

The cost of debentures. (1 mark)

The cost of retained earnings. (1 mark)

The cost of ordinary shares. (2 marks)

The amount of equity to be financed through the issue of new ordinary shares if the company is to

maintain the optimal capital structure. (2 marks)

Amount to be raised through debentures. (2 marks)

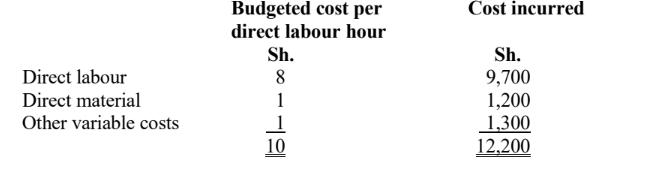

3. Wauza Piki Ltd. planned to manufacture 2,000 units of motorcycles in 2,200 hours. However, it took 2,000 hours to manufacture 2,000 units of motorcycles. The variable cost items are as follows:

Required:

Using the principles applicable to flexible budgeting, prepare in tabular format a performance report to the management of Wauza Piki Ltd. showing:

Budget based on 2,200 actual hours. (2 marks)

Budget based on 2,000 hours allowed. (2 marks)

Total budget variance. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Analyse TWO characteristics of good investment evaluation criteria. (4 marks)

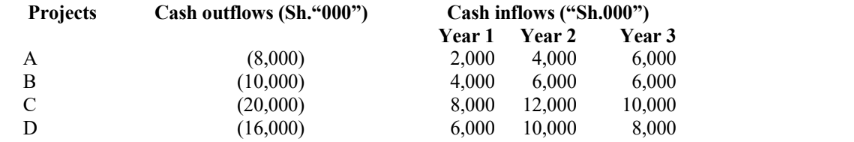

2. Mahari Ltd. is considering its capital budget for the year 2024. The following information relates to four mutually exclusive projects that the management is contemplating about:

Additional information:

1. The firm has a capital budget ceiling of Sh.20 million.

2. The cost of capital for Mahari Ltd. is 10%

3. The cash flows are assumed to occur at the end of each year.

Required:

Advise the management of Mahari Ltd. on the project to undertake using each of the following investments appraisal techniques:

Net present value (NPV). (6 marks)

Profitability index (PI). (4 marks)

3. A firm has a total investment of Sh.500 million in assets and 5 million outstanding ordinary shares at Sh.100 per share (par value). It earns a rate of 15% on its investment and has a policy of retaining 50% of the earnings. If the appropriate discount rate of the firm is 10%, determine the price of its share using Gordon’s Model.

At a payout of 50%. (2 marks)

At a payout of 80%. (2 marks)

At a payout of 20%. (2 marks)

(Total: 20 marks)