THURSDAY: 20 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Bidii Cement Company is listed in the local securities market. Some of the other listed cement manufacturing companies provide extensive disclosures in their external reports about their environmental policies and practices.

Required:

Discuss two reasons that may cause Bidii Cement Company to voluntarily disclose its environmental policies and practices as part of its annual reports. (4 marks)

Explain three potential advantages of voluntary environmental disclosures to Bidii Cement Company. (6 marks)

2. Milele Ltd. is a public limited company. As at 31 March 2019, Milele Ltd. had issued share capital of Sh.10 million. The shares are denominated at Sh.0.25 each. Milele Ltd.’s earnings attributable to its ordinary shareholders for the year ended 31 March 2019 were also Sh.10 million giving an earning per share of Sh.0.25.

The following transactions took place during the year ended 31 March 2020:

- On 1 July 2019, Milele Ltd. issued eight million ordinary shares at full market value.

- On 1 January 2020, a bonus issue of one ordinary share for every four ordinary shares held was made.

- Earnings attributable to ordinary shareholders for the year ended 31 March 2020 were Sh.13,800,000.

Transactions for the year ended 31 March 2021 were as follows:

- On 1 October 2020, Milele Ltd. made a rights issue of share of two new ordinary shares at a price of Sh.1.00 each for every five ordinary shares held. The offer was fully subscribed.

- The market price of Milele Ltd. ordinary shares immediately prior to the offer was Sh.2.40.

- Earning attributable to ordinary shareholders for the year ended 31 March 2021 were Sh.19,500,000.

Required:

Earning per share (EPS) for the year ended 31 March 2020 including comparative figure for the year ended 31 March 2019. (4 marks)

Earning per share (EPS) for the year ended 31 March 2021 including comparative figure for the year ended 31 March 2020. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Operating segment information in a set of financial statements has been viewed by some investors as just too much information which may be difficult to understand. Some investors argue that this information is also costly to produce and its cost outweighs its benefits.

Required:

Describe three benefits that could be derived by investors from reviewing the operating segment disclosures accompanying financial statements when making decisions on investments. (6 marks)

Explain two limitations of using operating segment information when making investment decisions. (4 marks)

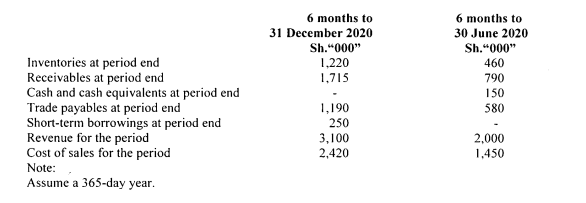

2. Drible Cable (DC) experienced a period of rapid expansion in the six months following the launch of a new product on 1 July 2020. The following information is available from the books of DC:

Note:

Assume a 365-day year.

Required:

For each of the periods above, calculate the following ratios:

Inventories turnover period. (1 mark)

Payables turnover period. (I mark)

Receivables turnover period. (1 mark)

Current ratio. (I mark)

Quick ratio. (1 mark)

Gross profit margin. (1 mark)

Using the calculations in (i) to (vi) above, comment on the financial performance of DC. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Duka Limited owns a piece of machinery and entered into an agreement to lease the machinery on 1 January 2017 In the lease contract, the company requires four annual payment of Sh.28,679 starting on 1 January 2017. The present value of the lease payments using a 10% discount rate is Sh.100,000 and the fair value of the equipment is Sh.90,000. The useful life of the machinery is four years and its salvage value is zero.

Required:

Duka Ltd.’s cumulative income related to the lease. (8 marks)

Distinguish between reporting a lease as an operating lease or as a finance lease in the financial statements. (4 marks)

Jane Mara, a financial analyst is seeking to identify companies with potential unrecorded leases. She studied the 2020 annual report of Basket Ltd. which reported an operating lease from 2020 to 2025 as shown below:

Basket Ltd.

Operating lease payments

Year Amount

Sh.”000″

2020 215

2021 I86

2022 160

2023 141

2024 136

2025 136

Jane Mara noted that Basket Ltd. had issued a bond with an effective interest rate of 6% per annum.

Required:

The present value of the operating lease commitment. (4 marks)

2. The following information relates to Minoh Ltd.’s pension plan as at 31 December 2020:

- The present value of a company’s defined benefit obligation is Sh.5,485 million and the fair value of the pension plan asset is Sh.5,798 million.

- The company has unrecognised transition liabilities of Sh.50 million, unrecognised actuarial losses of Sh.59 million and unrecognised past service costs of Sh.70 million.

- The present value of available future refunds and reductions in future contribution is Sh.3 I3 million.

Required:

The amount of the pension asset to be reported as at 31 December 2020 in the statement of financial position. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. International Accounting Standard (IAS) 10, Events After the Reporting Period, shall be applied in the accounting for, and disclosure of, events after the reporting period.

Required:

Explain the term “events after the reporting period”. (2 marks)

Highlight two types of events that are identified under the standard. (2 marks)

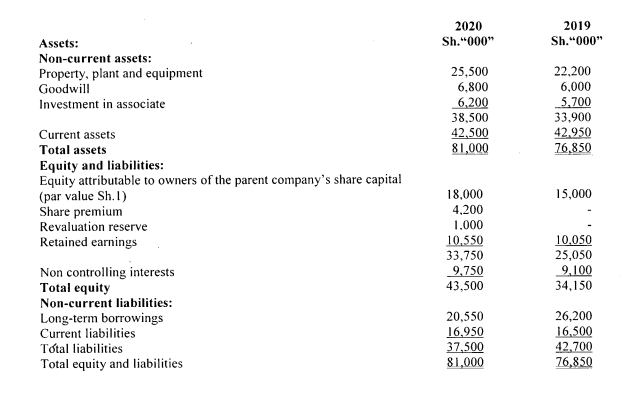

2. White Ltd. (WL) has a number of investments in subsidiary and associate entities. During the year ended 30 June 2020, WL acquired an investment in QB Ltd.

The statements of financial position of WL, group for the years ended 30 June 2020 and 30 June 2019 are shown below:

Additional information:

- During the year ended 30 June 2020, there was no disposal of property, plant and equipment. Depreciation charged for the year ended 30 June 2020 was Sh.1,200,000.

- WL’s share of the associate’s profit for the year ended 30 June 2020 was Sh.1,800,000.

- The total comprehensive income attributable to non-controlling interest for the year ended 30 June 2020 was Sh.350,000.

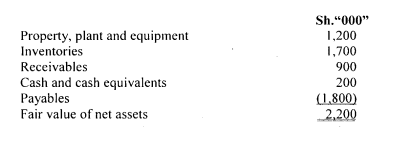

- WL acquired 75% of the equity share capital of QB on 1 January 2020 for a cash consideration of Sh.300,000 and the issue of 1,000,000 ordinary shares of Sh.1 each in WL. WL’s shares had a deemed value of Sh.2. 15 per share at the date of acquisition.

- The fair value of the net assets of QB acquired on 1 January 2020 were as follows:

- WL did not acquire or dispose of any other investments in the year. The group policy is to value non controlling interest at acquisition at its proportionate share of the fair value of the net assets acquired.

- In the year ended 30 June 2020, QB paid a dividend but WL did not pay any dividend.

Required:

Extracts from the consolidated statement of cash flows for WL for:

Cash flows from investing activities for the year ended 30 June 2020. (8 marks)

Cash flows from financing activities for the year ended 30 June 2020. (8 marks)

(Total: 20 marks)

QUESTION FIVE

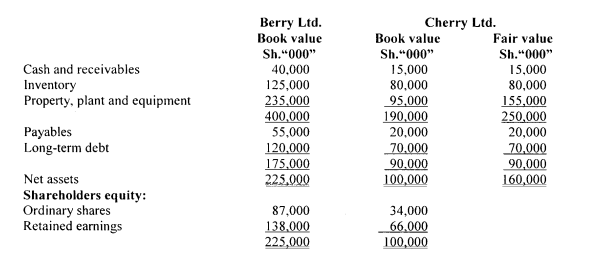

1. On 1 January 2020, Berry Ltd. acquired 90% of the outstanding shares of Cherry Ltd. in exchange for shares of Berry Ltd. with a fair value of Sh.180 million. The fair market value of Cherry Ltd.’s ordinary shares on the date of the exchange was Sh.200 million.

The following is a summary of the financial information of the two companies as at 31 December 2019:

Required:

The value of goodwill and the value of the non controlling interest on 1 January 2020 under the partial goodwill method. (3 marks)

Consolidated statement of financial position as at 1 January 2020. (7 marks)

2. RTZ Ltd. operates in country N and has established the NSh as its functional currency. RTZ Ltd. acquired a piece of machinery from an international supplier on 20 November 2020. The invoice remained unpaid at the year ended 31 December 2020:

Relevant exchange rates (where NSh/KSh 2.00 means Nsh 1 = Ksh.2.00) are:

20 November 2020 Nsh/Ksh2.00

31 December 2020 Nsh/Ksh2.15

Required:

In accordance with International Accounting Standard (IAS) 21, The Effect of Changes in Foreign Exchange Rates:

Distinguish between “functional currency” and “presentation currency”. (4 marks)

Highlight two factors that RTZ Ltd. might have considered when establishing Nsh. as its functional currency. (2 marks)

Calculate the amounts to be included in the financial statements of RTZ Ltd. for the year ended 31 December 2020 in respect to the above transaction. (4 marks)

(Total: 20 marks)