It can be defined as the ratio of the relative change of a dependent variable to changes in another independent variable. Elasticity can be analyzed in terms of demand and supply.

It can also be defined as a measure of responsiveess of quantity demanded of a good in to changes in income or prices of other related goods. There are three types of elasticity; price elasticity of demand, cross elasticity of demand and income elasticity of demand.

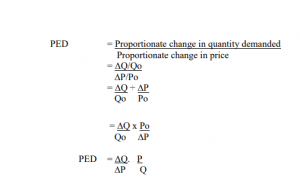

Price elasticity of demand it’s the measure of responsiveness of the quantity demanded of a commodity to changes in its own price. It is also referred to as own price elasticity. It abbreviated as PED/ED. It is calculated as follows

If changes in prices cause more than proportionate change in quantity demanded it is said to be price elastic, in this case ED >1. If changes in the price causes less than proportionate change in quantity demanded, then demand is said to be price inelastic this is represented by ED < 1. If changes in price causes proportionate change inn quantity demanded then, demand is said to be unit elastic or unitary elastic where ED= 1.

Types of elasticity

There are five types of elasticity of demand.

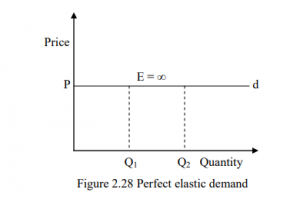

1.Perfectly elastic demand. Demand is said to be perfectly elastic when the consumers are willing to buy an amount of a commodity at a given price, but non at a slightly higher price. In this case elasticity of demand is equally to. The will be a horizontal straight line as illustrated in Figure 2.28. This is a case of a commodity in a perfectly competitive market. Where an increase in price may lead to a loss of all customers

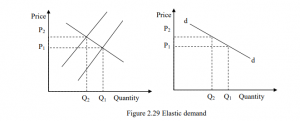

2.Elastic demand. Demand is said to be price elastic when a charge in price causes more than proportionate change in quantity demanded. In this case the value of elasticity of demand is greater than 1 and the demand curve will be gently sloped as indicated in Figure 2.29. This implies that if prices increase from P1 to P2 the quantity demanded falls in greater proportion from Q1 to

Q2 and vice versa. This is a case of luxury commodity which consumes can do without or a case of a substitute.

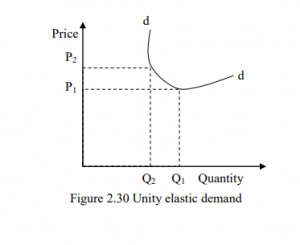

3.Unity elastic demand. Demand is said to unit elastic if changes in price cause proportionate change in quantity demanded. If price increase quantity falls in the same proportion and vice versa. ED = 1 and the demand curve will be rectangular hyperbola as illustrated in Figure 2.30. This is a case of a good that lies between a luxury and necessity such as soap opera film or movie.

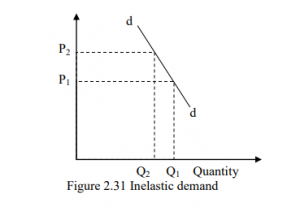

4.Inelastic demand. Demand is said to be price inelastic if changes in price causes less than proportionate change in quantity demanded. If prices increases the quantity falls in less proportion and if the prices falls the quantity demanded increases in less proportion ED < 1 as illustrated in Figure 2.31. This is a case of a good which is a necessity. These are goods which consumers can not do without but need not be consumed in fixed amount like an absolute necessity such a staple food like ugali and milk. It also applies in the case of habit forming goods like beer and cigarettes.

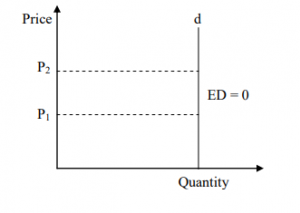

5.Perfectly inelastic demand. Demand is said to be perfectly price inelastic if changes in price has no effect on the quantity demand (ED= 0). In this case the demand curve will be vertical straight as illustrated in Figure 2.32. This is a case of a good which is an absolute necessity. A good that consumes cannot do without and have to consume in fixed amounts such as salt.

Factors affecting price elasticity of demand

- Substitutability. If a substitute is available in the relevant price range, quantity demanded will be elastic. The demand for a particular brand of cigarettes maybe considered being elastic because if there is existence of other brands that are close substitutes. However, the total demand for cigarettes may be inelastic because there are no close substitutes for cigarette. It can hence be said that the greater the number of substitutes for a given commodity, the greater will be its price elasticity of demand.

- The proportion of a consumer’s income spent on the commodity. If this proportion is very small as in the case of match boxes , the quantity demanded will tend to be inelastic. On the other hand if this proportion is relatively large as for example in the case of meat, demand will tend to be elastic. This implies that the greater the proportion of income which the price of the product represents, the greater price elasticity of demand will end to be.

- The extent to which the product is habit forming. Habit forming products like cigarettes or alcohol have a low price elasticity of demand. In the case of in addiction to, say drugs, the price elasticity of demand is likely to be even lower.

- The number of uses of a commodity. The greater the number of uses of the commodity, the greater the price of elasticity. The elasticity of alluminium for example is likely to be much greater than of butter because butter is mainly used

as food while alluminium has hundreds of uses such as electrical wiring and appliances. - The length of adjustments. The longer the period allowed for adjustment in the quantity demanded as a commodity the greater its price elasticity is likely to be. This is because it usually takes some time for new prices to be known and for consumers to make the actual switch. Consumers adjust buying habits slowly.

- The level of prices. If the ruling price is at the upper end of the demand curve, quantity demanded is likely to be more elastic than if it was towards the lower end. This is always true for a negatively sloped straight line demand curve.

- Necessities and luxuries Demand for luxury is likely to be price elastic while the demand for necessities is generally price inelastic. However, this depends with availability of close substitutes.

- Width/size of the market the wide definition of the market of a good, the lower is the price elasticity of demand. Thus for wide markets demand will tend to be price inelastic while for a small market demand will tend to be price elastic.

- Time demand for most goods and services tend to be more elastic in the long run as compared to the short run period. This is because consumers will take some time to respond to price changes. For instance, if the price of petrol falls relative

to diesel, it will take long for motorists to respond because they are locked in existing investment in diesel engines. - Durability of the commodity durable goods have low elasticity of demand or they are price elastic while perishable goods are price inelastic.

Importance of price elasticity of demand/economic application of the concept of elasticity

- The consumer needs knowledge of elasticity when spending income where more income is spent on goods whose elasticity of demand is inelastic and vice versa.

- The government imposes taxes with inelastic demand and vice versa. Devaluation when a country devalues or lowers the value of its currency. The currency is made cheaper relative to other currencies. This makes a country’s exports cheaper for foreigners. Its import expensive for the residents. For a country to benefit by increasing exports, the elasticity of demand must be high.

- Business/producers They use elasticity of demand on deciding on whether to charge high or lower prices or even deciding on commodities to bring to the market especially those which are price inelastic.

Income Elasticity of demand

It is the measure of responsiveness of demand due to change in income. Where income elasticity is positive this is a normal good.

Where income elasticity is negative this is an inferior good. When the demand of a good does not change with increase in income then income elasticity is zero. In wealthy countries for instance basic clothes will tend to have low income elasticity of demand while foreign will have high elasticity of demand as income increases. In poor countries basic commodities will have high income elasticity compared to manufactured expensive items.

Importance of Income Elasticity of Demand

- Business firms- if demand of a commodity is elastic to price, its possible to revenue by reducing prices. Businesses use specific information to know which price to increase to eliminate shortages or which price to reduce to eliminate surpluses.

- Government uses elasticity to determine the yield of indirect taxes. Inelastic commodities are highly taxed. However, if demand of a commodity is elastic an increase in tax will hinder production

- Price elasticity is relevant for a country considering devaluation as a means of rectifying balance of payment disequilibrium. Devaluation decreases imports and increases exports. However, this will depend on demand of import and

export elasticities. - It helps to explain price instabilities in the agricultural sector

- Monopolists apply price discrimination by understanding the demand elasticities. High price is charged to those markets with lower price elasticity

Factors affecting Income elasticity of demand

- Nature of the need that the commodity covers. For certain goods and services the percentage of income spent declines as income increases such as food.

- The initial level of income of a country (level of development) TV sets, refrigerators, motors vehicles are considered as luxuries in underdeveloped countries while they are considered as necessities in countries with high per capital income.

- Time period. The demand for most goods and services will tend to be income elastic in the long run as compared to short run period. This is because the consumption pattern adjusts with time and also with change in income.

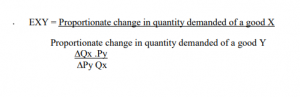

Cross elasticity of demand

It is the measure of responsiveness of quantity demanded of a good due to changes in the price of another related good. It is abbreviated as EXY where X and Y are to goods. It is calculated as follows:

The sign of cross elasticity of demand is positive if the good X and Y are substitutes and negative if X and Y are complimentary. The higher the absolute value of cross elasticity of demand the stronger the degree of substutability or complimentaribility. The main determinant of cross elasticity is the nature of the commodity relative to their uses. If two goods can certify equally the same need the cross elasticity will be high and vice versa.

Importance of cross elasticity of demand

- Protection of local industries. If the government imposes a tariff on a good with the intention of protecting a local industry then the local product and the imported product must be close substitutes for the government to achieve it objectives

- If a firm is in a competitive market, there a high positive elasticity of demand between its products and those of competitors. For such a firm, it will not be in it‟s interests to increase the price of its product as this may result to more than proportionate reduction in its sales. However, it might consider lowering the prices of its products in the hope of attracting customers from other firms.

- For product with high degree of complimentarity, a fall in price of one of the goods due to increase in supply will benefit the producers of a compliment product due to an increase in sales. E.g. if there is a fall in prices of vehicles, due

to an increase in supply the suppliers of fuel experience an increase in sales because more cars will be bought.

Elasticity of Supply

It is the measure of responses of quality supply of a commodity to change in the factors affecting supply

Price elasticity of supply

It is the measure of responses of quality supplied of a commodity to change in its two prices. It is abbreviated as ES and calculated as:

Proportional change in quality supplied

Proportional change in price

E.S= ∆Qs . P

∆P Qs

ES will have appositive value because of the direct relationship between the price of the

product and quality supplied.

If ES is greater than 1, then the supply is said to be price elastic

If Es <1 then supply is price inelastic

If Es =1 then supply is unit elastic.

Type of price elasticity of supply

1. Perfectly elastic supply

2. Elastic supply

3. Unit elastic supply

4. Inelastic supply

5. Perfectly inelastic supply.

Factors affecting price elasticity of supply

- Mobility of factors of production If they are highly mobile then supply will be price elastic since more factors can be employed quickly when the prices increase thus increase in supply

- The level of employment of resources It refers to the utilization and allocation of resources. If the factors are fully utilized supply will be price inelastic due to the fact that all the facts are occupied and thus can not be mobilized in order to increase supply. However if they are under employed, supply will be price elastic.

- Production period for product that take short period of time to produce their supply tend to be price elastic. While thus that take a longer period will be price inelastic because it will take a while before the products can reach the market.

- Nature of the commodity Price elasticity of supply for perishable goods tend to be inelastic due to the fact that the goods do not respond to price fall as they can not be easily stored. On the other hand supply for durable goods tend to be price elastic since they can be store when the price falls thus contracting supply.

- Risk taking If the entrepreneurs are willing to take risk then supply of the products will be price elastic. Risk taking will in return be determined by the prevailing conditions in the economy. E.g. Political stability, security, government incentives, infrastructure, etc.

- Level of stock If it’s high supply will be price elastic because if the price of a good increases more of the good will is supplied from the stock

- Time period Supply for most goods and services will tend to be more elastic in the long run than in the short run because producer need more time to reorganize factors of production so that they can increase supply of the products.

Importance of price elasticity of supply

- If supply of a good is price elastic thus an increase in demand will benefit both the producer and consumer of products because the producer will be in apposition to supply relatively more of their products and consumer will eventually pay a relatively lower price.

- If the supply of commodity I price inelastic business may risk losing revenue when there is a fall in the price of their products. This is because they will be forced to sell their products at a loss or a reduced price margin, e.g. In the case of perishable goods, however in the supply of the goods is price elastic the business people may store their products when price fall thus contracting

supply e.g. the case of durable goods.

Relationship between total revenue and elasticity

- Elastic demand Increase in price will reduce the total revenue while a fall in price increase the total revenue

- Inelasticity demand Increase in price will reduce the total revenue while a fall in price causes reduction in total revenue.

- Unit demand change in price will leave the price unchanged.

Application of elasticity in economic policy decisions

- Products/services pricing decisions

- Customer spending programmes

- Production decisions

- Government policy orientation

- Taxation policy

- Evaluation policies

- Price control/minimum

- Price discrimination

- Shift of the tax burden