CIFA

PORTFOLIO MANAGEMENT

PART 2

SECTION 4

STUDY TEXT

REVISED ON: JUNE 2019

GENERAL OBJECTIVE

This paper is intended to equip the candidate with the knowledge, skills and attitudes that will enable him/her to apply investment tools in portfolio management.

11.0 LEARNING OUTCOMES

On successful completion of this paper, the candidate should be able to:

- Apply various investment strategies to manage a portfolio

- Construct and manage portfolios

- Assess the risk levels of portfolios

- Prepare investment policy statements

- Understand the application of tax in private wealth management

- Apply behavioural finance concepts in portfolio management.

CONTENT

11.1 Overview of portfolio management

- Definition of portfolio management and strategies

- Portfolio perspective and its importance

- Steps of the portfolio management process and the components of those steps

- Types of investors, their distinctive characteristics and specific needs

- Pooled investment products (mutual funds, exchange traded funds, separately managed accounts, hedge funds, buyout funds/private equity funds and venture capital funds)

11.2 Introduction to risk and return of a portfolio

- Measures of return, their calculation, interpretation, and uses: holding period return(HPR), average returns (arithmetic average return, geometric average), time-weighted return, money weighted return, gross return, pre-tax nominal return, after tax nominal return, real return, leveraged return

- Characteristics of major asset classes used to construct portfolios

- Portfolio selection; concept of risk aversion; utility theory

- The effect of the number of assets in a multi asset portfolio on the diversification benefits

11.3 Capital market theory

- Introduction to modern portfolio theory

- Implications of combining a risk-free asset with a portfolio of risky assets

- Capital allocation line (CAL) and capital market line (CML)

- Systematic and non-systematic risk

- Return generating models and their uses

- Capital asset pricing model (CAPM): assumptions; applications; practical limitations; implications

- Security market line (SML) and its application, the beta coefficient, market risk premium

- Market model: predictions with respect to market returns, variances and co-variances

- Adjusted beta and historical beta: t heir use as predictors of future betas

- Minimum variance frontier: importance and problems related to its instability

- Arbitrage pricing theory (APT): underlying assumptions and its relation to multifactor models, estimation of expected return on an asset given its factor sensitivities and factor risk premiums, determination of existence of an arbitrage opportunity and how to utilise it

- Understanding and interpretation of active risk, tracking error, tracking risk, information ratio, factor portfolio and tracking portfolio

11.4 Portfolio planning and construction

- Definition of portfolio planning

- The investment policy statement (IPS): major components and its importance

- Capital market expectations

- Investment objectives: risk and return objectives for a client

- Investors financial risk tolerance: investors ability (capacity) to bear risk and willingness to take risk

- Investment constraints: liquidity, time horizon, tax issues, legal and regulatory factors, unique circumstances, and their effect to the choice of a portfolio

- Ethical responsibilities of a portfolio manager

- Introduction to asset allocation:

11.5 Active portfolio management: Residual risk and return

- Definition of active portfolio management

- Alpha and information ratio (IR): their definition in both post ante and ex ante

- Relationship between information ratio and alphas T-statistic

- The concept of the value added (VA) and the objective of active portfolio management in terms of value added

- The optimal level of residual risk to be assumed with respect to manager ability and investor risk aversion

- Relationship between the choice of a particular active strategy and investor risk aversion

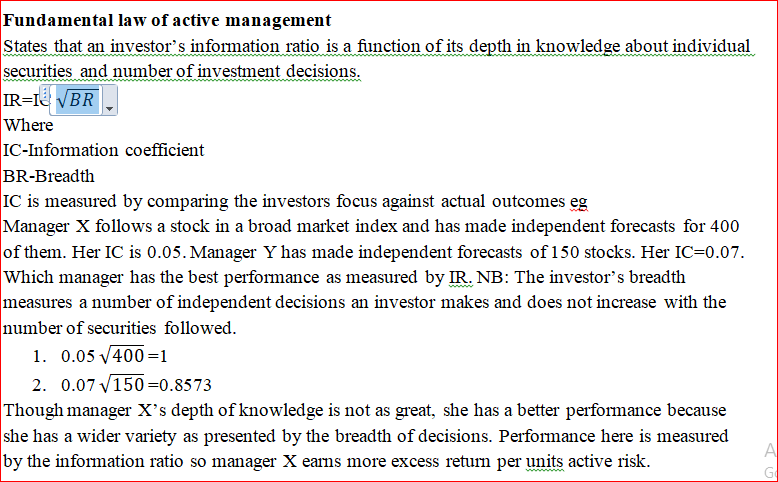

11.6 Fundamental law of active management

- Information coefficient (IC) and breadth (BR) as used in determining information ratio

- The ‘Fundamental law of active management’: Definition; assumptions; relationship between the optimal level of residual risk, information coefficient, and breadth; relationship between the value added, information coefficient, and breadth

- Market timing versus security selection in relation to breadth and investment skill

- Effect of augmenting original investment strategy with other investment strategies or information changes

11.7 Behavioural finance

- Introduction to behavioural finance: Definition; traditional finance versus behavioural finance

- Expected utility versus prospect theories of investment decision

- Effect of cognitive limitations and bounded rationality on investment decision making

- Behavioural biases of individuals: cognitive errors versus emotional biases; commonly recognized behavioural biases for financial decision making and their implications; individual investor’s behavioural biases; the effects of behavioural biases on investment policy and asset allocation decisions, and how these effects could be mitigated

- Behavioural finance and investment process: uses and effects of classifying investors in personality types; effects of behavioural factors on advisor client interactions; the influence of behavioural factors on portfolio construction; application of behavioural finance on portfolio construction process; effects of behavioural factors on an investment analyst forecasts and investment committee decision making: mitigation of these effects

11.8 Risk management

- Introduction: risks faced by an organisation: market risk, credit risk, liquidity risk; operations risk; model risk; settlement risk; regulatory risk; legal risk; tax risk; accounting risk

- The risk management process: strengths and weaknesses of a company’s risk management process

- Risk governance and risk reduction.

- Enterprise risk management system: steps in an effective enterprise risk management system

- A company’s or a portfolio’s exposures to financial and non-financial risk factors

- Value at risk (VaR): its role in measuring overall and individual position market risk.

- Methods for estimating VaR: the analytical (variance–covariance), historical, and Monte Carlo methods

- Extensions of VaR: Cash flow at risk, earnings at risk, and tail value at risk

- Stress testing and its alternative types

- Methods for managing market risk: risk budgeting, position limits, and other methods

- Methods for managing credit risk: exposure limits, marking to market, collateral, netting arrangements, credit standards, and credit derivatives

- Measures of risk- adjusted performance: Sharpe ratio, risk- adjusted return on capital, return over maximum drawdown, and the Sortino ratio

- Use of VaR and stress testing in setting capital requirements

11.9 Private Wealth Management Taxes

- Local taxation regimes as in relation to the taxation of dividend, income, interest income, realised capital gains, and unrealised capital gains

- Impact of different types of taxes and tax regimes on future wealth

- Computation of accrual equivalent tax rates and after-tax returns

- Tax profiles of different types of investment accounts and explain how taxes and asset allocation relate.

Estate planning

- Purpose of estate planning and the basic concepts of domestic estate planning

- Forms of wealth transfer taxes and impact of important non tax issues such as legal system

- a family’s core capital and excess capital

11.10 Emerging issues and trends

TOPIC PAGE NO

- OVERVIEW OF PORTFOLIO MANAGEMENT………………………………5

- INTRODUCTION TO RISK AND RETURN OF A PORTFOLIO……….12

- CAPITAL MARKET THEORY………………………………………………………44

- PORTFOLIO PLANNING AND CONSTRUCTION………………………………….64

- ACTIVE PORTFOLIO MANAGEMENT: RESIDUAL RISK AND RETURN……87

- FUNDAMENTAL LAW OF ACTIVE MANAGEMENT………96

- BEHAVIOURAL FINANCE…………………………………………………………99

- RISK MANAGEMENT……………………………………………………………..106

- PRIVATE WEALTH MANAGEMENT…………………………………………115

SAMPLE NOTES

CHAPTER ONE

OVERVIEW OF PORTFOLIO MANAGEMENT

Overview of Portfolio Management

The art of selecting the right investment policy for the individuals in terms of minimum risk and maximum return is known as portfolio management.

Portfolio management refers to managing an individual’s investments in the form of bonds, shares, cash, mutual funds etc so that he earns the maximum profits within the stipulated time frame.

Also, it refers to managing money of an individual under the expert guidance of portfolio managers.

In a layman’s language, the art of managing an individual’s investment is called portfolio management.

Need for Portfolio Management

Portfolio management presents the best investment plan to the individuals as per their income, budget, age and ability to undertake risks.

Portfolio management minimizes the risks involved in investing and also increases the chance of making profits.

Portfolio managers understand the client’s financial needs and suggest the best and unique investment policy for them with minimum risks involved.

Portfolio management enables the portfolio managers to provide customized investment solutions to clients as per their needs and requirements.

Explain the importance of the portfolio perspective

According to the portfolio perspective, individual investments should be judged in the context of how much risk they add to a portfolio rather than on how risky they are on a stand-alone basis.

Investors, analysts, portfolio managers should analyze the risk return trade-off of the portfolio as a whole, not the risk return trade-off of the individual investments in the portfolio, because unsystematic risk can be diversified away by combining the investments into a portfolio. The systematic risk that remains in the portfolio is the result of the economic fundamentals that have a general influence on the security returns, such as GDP growth, unexpected inflation, consumer confidence, unanticipated changes in credit spreads, and business cycle.

November 2015 Q1A

December 2017 Q1a

Describe the steps of the portfolio management process and the components of those steps

The three steps in the portfolio management process are the planning step (objectives and constraint determination, investment policy statement creation, capital market expectation formation, and strategic asset allocation creation); the execution step (portfolio selection/composition and portfolio implementation); and the feedback step (performance evaluation and portfolio monitoring and rebalancing).

SAMPLE NOTES

CHAPTER TWO

INTRODUCTION TO RISK AND RETURN OF A PORTFOLIO

INTRODUCTION

Construction of an optimal portfolio is an important objective for an investor. In this chapter, we will explore the process of examining the risk and return characteristics of individual assets, creating all possible portfolios, selecting the most efficient portfolios, and ultimately choosing the optimal portfolio tailored to the individual in question.

During the process of constructing the optimal portfolio, several factors and investment characteristics are considered. The most important of those factors are risk and return of the individual assets under consideration. Correlations among individual assets along with risk and return are important determinants of portfolio risk. Creating a portfolio for an investor requires an understanding of the risk profile of the investor. Although we will not discuss the process of determining risk aversion for individuals or institutional investors, it is necessary to obtain such information for making an informed decision. In this chapter, we will explain the broad types of investors and how their risk–return preferences can be formalized to select the optimal portfolio from among the infinite portfolios contained in the investment opportunity set.

- INVESTMENT CHARACTERISTICS OF ASSETS

Financial assets are generally defined by their risk and return characteristics. Comparison along these two dimensions simplifies the process of selecting from millions of assets and makes financial assets substitutable. These characteristics distinguish financial assets from physical assets, which can be defined along multiple dimensions. For example, wine is characterized by its grapes, aroma, sweetness, alcohol content, and age, among other factors. The price of a television depends on picture quality, manufacturer, screen size, number and quality of speakers, and so on, none of which are similar to the characteristics for wine. Therein lies one of the biggest differences between financial and physical assets. Although financial assets are generally claims on real assets, their commonality across two dimensions (risk and return) simplifies the issue and makes them easier to value than real assets. In this section, we will compute, evaluate, and compare various measures of return and risk.

2.1. Return

Financial assets normally generate two types of return for investors. First, they may provide periodic income through cash dividends or interest payments. Second, the price of a financial asset can increase or decrease, leading to a capital gain or loss.

Certain financial assets, through design or choice, provide return through only one of these mechanisms. For example, investors in non-dividend-paying stocks, such as Google or Baidu, obtain their return from capital appreciation only. Similarly, you could also own or have a claim to assets that only generate periodic income. For example, defined benefit pension plans, retirement annuities, and reverse mortgages1 make income payments as long as you live.

2.1.1. Holding Period Return

Returns can be measured over a single period or over multiple periods. Single period returns are straightforward because there is only one way to calculate them. Multiple period returns,

SAMPLE NOTES

CHAPTER THREE

CAPITAL MARKET THEORY

Introduction

Investors are interested in knowing the systematic risk when they search for efficient portfolios. They would like to have assets with low beta co-efficient i.e. systematic risk. Investors would opt for high beta co-efficient only if they provide high rates of return. The risk averse nature of the investors is the underlying factor for this behavior. The capital asset pricing theory helps the investors to understand the risk and return relationship of the securities. It also explains how assets should be priced in the capital market.

The CAPM Theory

Markowitz, William Sharpe, John Lintner and Jan Mossin provided the basic structure for the CAPM model. It is a model of linear general equilibrium return. In the CAPM theory, the required rate return of an asset is having a linear relationship with asset’s beta value i.e. undiversifiable or systematic risk.

May 2017 Q2b

Assumptions

- An individual seller or buyer cannot affect the price of a stock. This assumption is the basic assumption of the perfectly competitive market.

- Investors make their decisions only on the basis of the expected returns, standard deviations and co variances of all pairs of securities.

- Investors are assumed to have homogenous expectations during the decision-making period.

- The investor can lend or borrow any amount of funds at the riskless rate of interest. The riskless rate of interest is the rate of interest offered for the treasury bills or Government securities.

- Assets are infinitely divisible. According to this assumption, investor could buy any quantity of share i.e. they can even buy ten rupees worth of Reliance Industry shares.

- There is no transaction cost i.e. no cost involved in buying and selling of stocks.

- There is no personal income tax. Hence, the investor is indifferent to the form of return either capital gain or dividend.

SAMPLE NOTES

CHAPTER FOUR

PORTFOLIO PLANNING AND CONSTRUCTION

Portfolio Planning

Is a program developed in advance of constructing a portfolio that is expected to satisfy the client’s investment objectives. The written document governing this process is the investment policy statement (IPS).

MAY 2018 Q2a

Explain the role of the investment policy statement in the portfolio management process and describe the elements of an investment policy statement

Investment policy statement is a formal document that governs investment decision making, taking into account objectives and constraints. The main role of the IPS is to:

- Be readily implemented by current or future investment advisors (i.e. it is easily transportable).

- Promote long term discipline for portfolio decisions.

- Help protect against short-term shifts in strategy when either market environment or portfolio performance cause panic or overconfidence.

There are numerous elements to an IPS. Some elements that are typically included are:

- Introduction: describes the client

- Statement of purpose

- Statement of duties and responsibilities: Of the client, asset custodian, and investment managers

- Procedures: Related to keeping the IPS updated and responding to unforeseen events

- Investment objectives: The client’s investment needs, specified in terms of required return and risk tolerance

- Investment constraints: Factors that may hinder the ability to meet investment objectives; typically categorized as time horizon, taxes, liquidity, legal and regulatory, and unique needs

- Investment guidelines: For example, whether leverage or derivatives are allowed

- Evaluation and review-Related to feedback on investment results

- Appendices: May specify the portfolio’s strategic asset allocation or rebalancing policy

SAMPLE NOTES

CHAPTER FIVE

ACTIVE PORTFOLIO MANAGEMENT: RESIDUAL RISK AND RETURN

The tracking risk is the standard deviation of active return and is a measurement of active risk (volatility of the benchmark).

Example

Suppose there are two managers, C and M. Calculate their information ratio

| C | M | |

| Active return | 0.4% | 0.62% |

| Active risk | 5.6% | 9.2% |

C= 0.4/5.6 =0.071 M= 0.62/9.2= 0.067

Even though M has the highest active return on a risk adjusted basis, it slightly underperforms C has its IR is lower. For every 1% in tracking risk, C delivered 0.071% in active return whereas M delivered 0.067%.

SAMPLE NOTES

CHAPTER SIX

FUNDAMENTAL LAW OF ACTIVE MANAGEMENT

Allocating to managers

Given funds to invest, an investor has a series of decisions to make. The investor must first decide which asset class to allocate the funds to and in what weights. At this level, the focus is on maximizing expected return for a given level of risk. In the first step in deciding how much equity to allocate to a group of equity managers the investors would want to maximize the utility of his active return.

The utility function for active return is similar to that for expected return. The utility of active return increases as active return increases as active risk decreases and as the investors risk aversion of active risk decreases.

SAMPLE NOTES

CHAPTER SEVEN

BEHAVIOURAL FINANCE

Behavioural finance looks at why people make irrational decisions.

Much of conventional/Traditional finance is based on rational and logical theories, such as the CAPM and EMH.

These theories assume that people, for the most part, behave rationally and predictably

But the real world is a very messy place people behave very unpredictably.

Contrary to convention we are not always “wealth maximisers”.

Buying a lottery tickets is financially irrational for example.

Behavioral finance seeks to explain why we buy them.

The “Anomalies” that behavioural finance seeks to explain:

- January Effect

Average monthly return for small firms is consistently higher in January than any other month of the year.

Conversely, EMH suggests a “random walk”

- The Winner’s Curse

The winning bid in an auction often exceeds the intrinsic value of the item purchased – maybe due to increased bid aggressiveness as more bidders enter the market

- Equity Premium Puzzle

CAPM says investors with riskier investments should get higher returns – but not so much!

Shares historically return 10% and government (risk free) bonds 3% – yet shares are not over 3 times more risky – so why is the return premium so high?

Behavioural finance shows people have a loss aversion tendency– so are more worried by losses in comparison to potential gains – so in fact a very short-term view on an investment.

So shareholders overreact to the downside changes.

Therefore, it is believed that equities must yield a high-enough premium to compensate for the investor’s considerable aversion to loss.

Key concepts of Behavioural Finance

- Anchoring

We tend to “anchor” our thoughts to a reference point – especially in new situations

Large Coffee – £5

Medium Coffee – £3.50

Small Coffee – £3

The large is the anchor – get you used to a price (with no logic behind it) thus now making the medium seem cheap. Especially as small (another anchor) is £3.

A share falls in value from £80 to £30 – it now seems a bargain – but thats just not rational – you need to see the fundamentals of WHY the price fell not just look at the £80 anchor

SAMPLE NOTES

CHAPTER EIGHT

RISK MANAGEMENT

Risk management:

The main features of the risk management process are…

- Setting risk management policies and procedures

- Defining risk tolerance

- Identifying risk exposure

- Measuring risk exposure.

- Making appropriate adjustments when risk exposure moves beyond the ranges established in step 2

And risk governance is…

- “…the process of setting overall policies and standards in risk management.”

- Senior management MUST be involved in this process

- CENTRALIZED is better than decentralized.

- Actually, the centralized approach to risk governance is what they are talking about when they use the term Enterprise Risk Management.

And enterprise risk management is good because…

- It considers risk from a firm-wide holistic perspective.

- It allows senior management to make better-informed decisions.

- Evaluate a company’s or a portfolio’s exposures to financial and nonfinancial risk factors

| Financial Risk Factors | Notes |

| Credit Risk | – Traditionally defined as default risk. – Credit risk can be hedged |

| Liquidity Risk | – Usually measured by bid/ask spread, which should be low. – Transaction volume is also a rough measure and higher means more liquid. – Holding small-cap equities is a liquidity risk because they may be sold at a discount. |

| Commodity Price Risk | – Can be hedged. |

| Market Risk | – Can be hedged. |

SAMPLE NOTES

CHAPTER NINE

PRIVATE WEALTH MANAGEMENT

Global tax regimes

4 basic types of taxes on investments:

- Interest income tax

- Dividend income tax

- Capital gains tax (realized and unrealized)

- Wealth tax

- Countries usually treat these returns differently for tax purposes.

- Differential tax treatment is likely to affect how you invest – or at least which accounts you use.

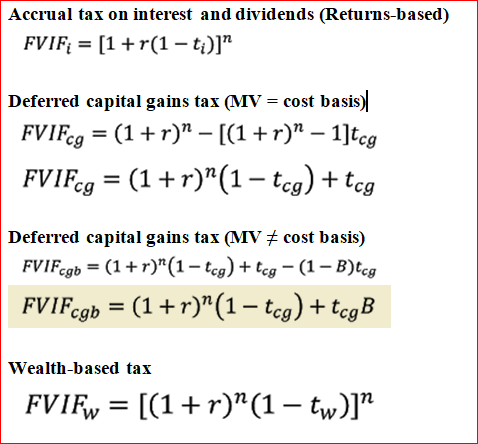

Tax regime impact

Determine the effects of different types of taxes and tax regimes on future wealth accumulation

SAMPLE NOTES